[ad_1]

Meals is among the most seen gadgets within the common American finances. We eat every day and store for meals steadily. Groceries are additionally one of many extra versatile gadgets in a finances: you possibly can’t change your hire or automobile cost, however you possibly can shift your grocery buying patterns. Let’s look nearer on the common price of groceries and the way it varies with location, earnings, and household dimension.

Groceries are often outlined as meals gadgets which are ready and consumed within the residence. Cash spent on consuming out or ordering out doesn’t qualify. Consumable gadgets typically bought in grocery shops, like cleansing provides and private hygiene gadgets, may additionally be categorized as groceries.

Common Month-to-month Meals Spending

Right here’s a breakdown of the typical American month-to-month spending sample. Meals is the third largest expense, nevertheless it’s not damaged down into groceries and meals ready exterior the house.

Meals spending contains groceries and meals away from residence, which is any meals that you simply pay another person to organize for you. On common, People spent $779 per 30 days on meals in 2022 and $9,343 over the total 12 months. Right here’s how that breaks down.

How A lot Does an Common American Spend on Groceries Every Month?

When contemplating solely grocery bills, the typical American spends about $475 month-to-month and a complete of $5,703 all year long.

How A lot Do People Must Spend on Groceries

Are People spending greater than they should spend on groceries?

The US Division of Agriculture has created 4 meals plans that People can observe; the Thrifty Plan, the Low-cost Plan, the Average-cost Plan, and the Liberal Plan[1].

These plans think about the age and gender of an individual to calculate the typical meals price. The plans are constructed on the idea that each one meals are cooked at residence and meet dietary suggestions. Figures are up to date commonly to account for inflation.

Listed below are the typical meals prices listed within the December 2023 USDA Meals Plan[2,3]:

The common month-to-month grocery invoice of a household of two adults and one 5 12 months outdated baby within the US following the official USDA reasonable meals plan is $898. That’s considerably increased than the typical family meals expenditure of $779. The disparity is as a result of many American households don’t have youngsters, which brings down the typical expenditure.

US Census knowledge signifies that the typical household family dimension is 3.2 folks, whereas the typical non-family family dimension is only one.25 folks. The typical meals expenditure isn’t damaged down by household and non-family households, however household households can have considerably increased meals expenditures than non-family households.

Increased Earnings Earners Spend Extra on Groceries

Earnings has a significant impression on grocery spending. Unsurprisingly, a better earnings rolls out a smorgasbord of choices. Folks with increased incomes can afford to pay extra for natural produce, imported meals, and gourmand gadgets[4].

Low incomes additionally affect total selections. In accordance with a 2019 examine, lower-income households buy fewer wholesome meals like greens and dairy merchandise than households with a better earnings. The examine famous that “lower-income households had decrease (poorer diet high quality) scores in contrast with higher-income households”.

Low-income households additionally pay extra for the meals they purchase. Customers can save important quantities by shopping for non-perishable gadgets in bulk, however a tighter finances places money-saving bulk purchases out of attain. Low-income households store on-line much less steadily, they usually have much less entry to massive grocery shops with aggressive pricing.

How Has the Value of Groceries Modified Over the Years?

Common meals expenditures for each meals ready at residence and meals ordered exterior the house have elevated steadily for a few years, with a very sharp soar throughout the excessive inflation interval of 2022[4].

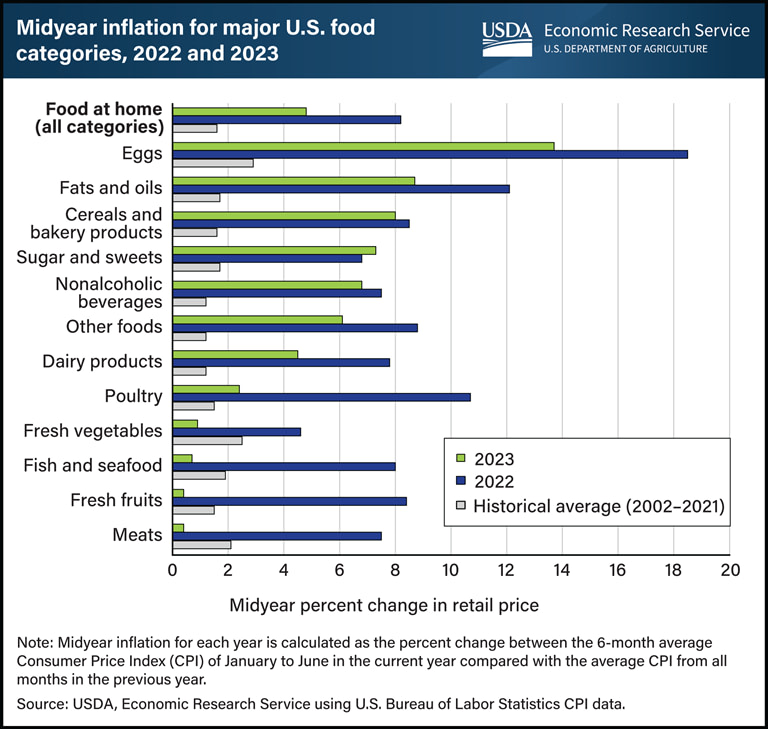

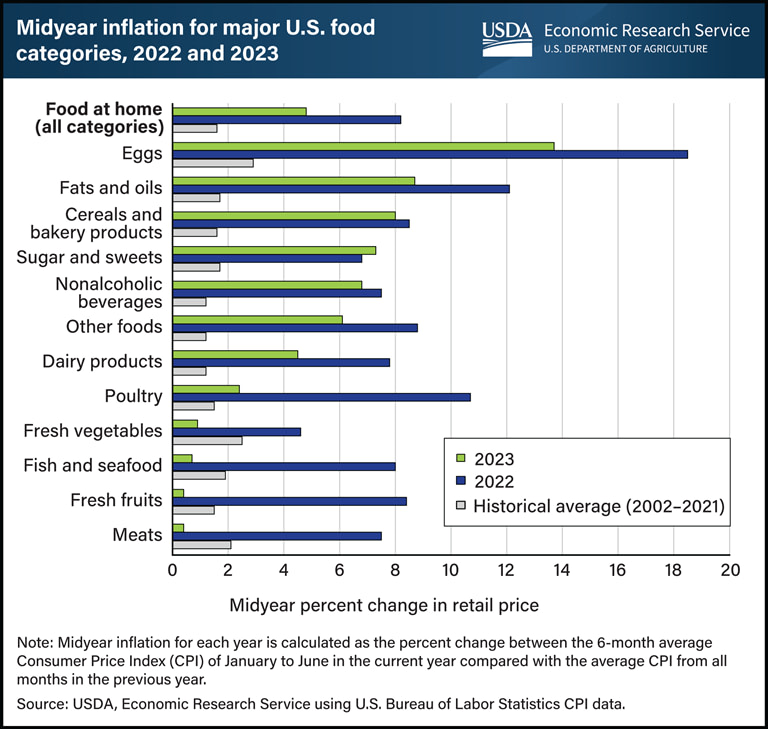

Meals costs elevated sharply throughout the inflation surge in 2022. Meals worth inflation abated considerably in 2023 however was nonetheless effectively above historic averages.

Egg and poultry costs had been hit by an outbreak of Extremely Pathogenic Avian Influenza (HPAI). Egg costs had the most important worth improve (32.2%) between 2021 and 2022 of any class tracked by USDA. Beef and veal costs elevated the least (5.3%) between 2021 and 2022 and customarily declined from peak costs in November 2021.

The USDA predicts that food-at-home costs will drop 0.6% in 2024, with food-away-from-home costs forecast to rise 4.9%[5].

The Common Value of Groceries by State

The typical price of groceries varies significantly by state. Hawaii and Alaska sometimes see the highest prices, as many items should be shipped over massive distances[6].

Conclusion

Earnings is a basic issue influencing family spending on groceries. Increased earnings permits households to allocate more cash for meals and different bills. Excessive-income households could have the flexibleness to decide on premium and natural merchandise, contributing to a better total grocery invoice.

Decrease-income households typically face finances constraints, main them to make cost-conscious selections. Dietary selections, cultural preferences, and way of life choices affect the kinds of meals gadgets folks buy.

Family grocery spending is a fancy final result influenced by a mixture of things, together with earnings, demographic traits, location, preferences, financial situations, and exterior occasions. Understanding these elements helps policymakers, companies, and people make knowledgeable choices about budgeting, useful resource allocation, and responding to dynamic market situations.

The content material on finmasters.com is for academic and informational functions solely and shouldn’t be construed as skilled monetary recommendation. Finmasters isn’t a monetary establishment and doesn’t present any monetary services or products. We try to offer up-to-date info however make no warranties relating to the accuracy of our info.