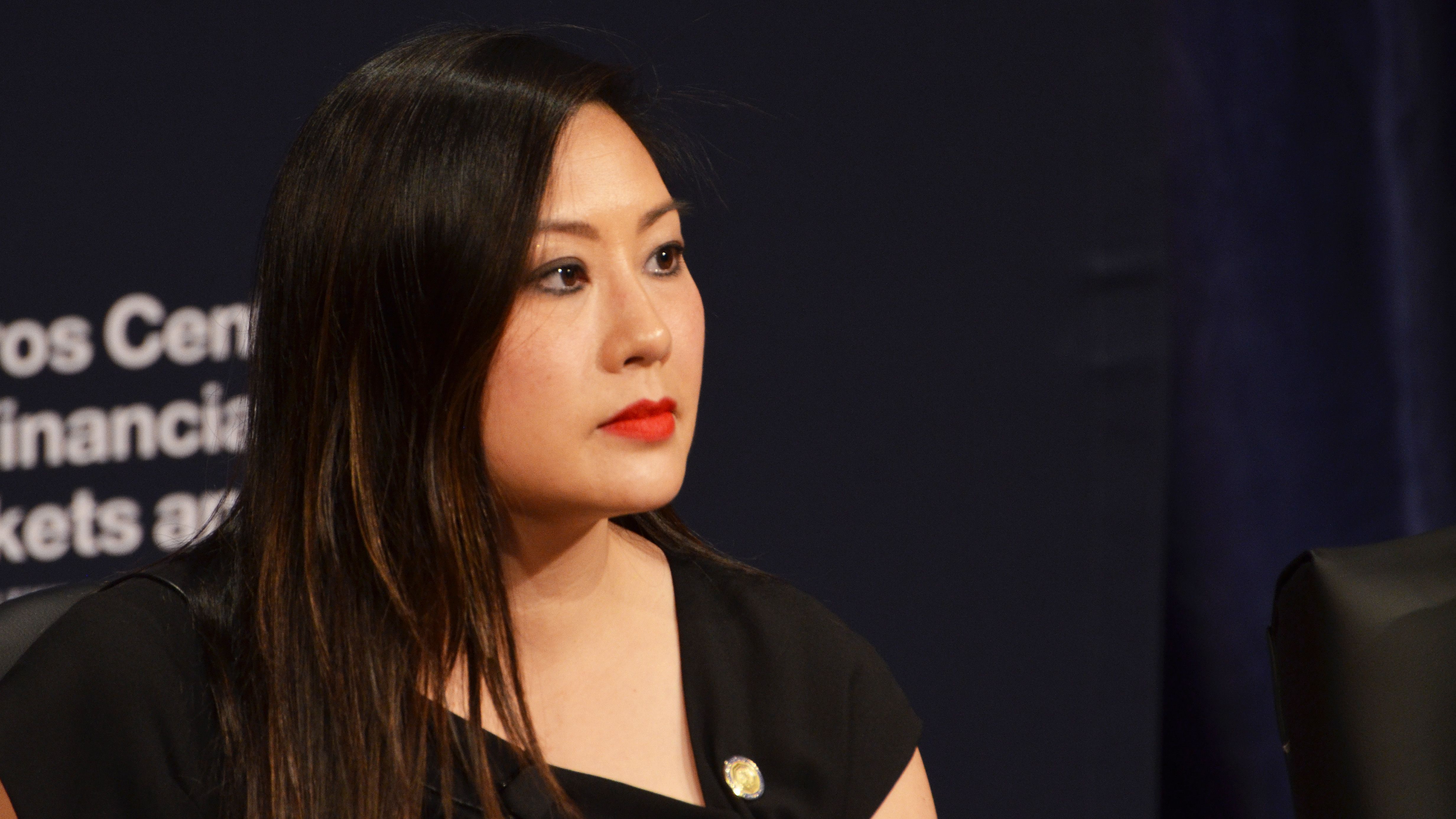

The U.S. Commodity Futures Buying and selling Fee’s authorized marketing campaign in opposition to prediction market platforms equivalent to Polymarket and Kalshi cannot simply be shut down, based on Caroline Pham, the appearing company chairman put in place by President Donald Trump.

Pham mentioned the company will collect consultants for a roundtable assembly, in all probability subsequent month, that may construct a case for a way the fee should method regulation and oversight of companies that provide betting on occasion contracts. She famous that regardless of her continued objections lately to former Chairman Rostin Behnam’s enforcement stance in opposition to prediction markets — together with wagers made on sporting occasions and U.S. political outcomes — the company moved too far on its path to simply reverse it.

“Sadly, the undue delay and anti-innovation insurance policies of the previous a number of years have severely restricted the CFTC’s capacity to pivot to common sense regulation of prediction markets,” Pham mentioned. “The present fee interpretations relating to occasion contracts are a sinkhole of authorized uncertainty and an inappropriate constraint on the brand new administration.”

Establishing the roundtable is a “essential first step with the intention to set up a holistic regulatory framework that may each foster thriving prediction markets and defend retail prospects from binary choices fraud equivalent to misleading and abusive advertising and marketing and gross sales practices,” Pham mentioned.

The CFTC misplaced an preliminary court docket case in opposition to Kalshi when a U.S. federal decide dominated late final yr that the company could not cease the agency from itemizing election contracts. Nonetheless, the company pursued an enchantment with the next court docket, and Kalshi argued in that new authorized dispute that solely Congress can halt election betting.

Learn Extra: CFTC Fines Crypto Betting Service Polymarket $1.4M for Unregistered Swaps

The CFTC had taken a place by way of guidelines, orders and enforcement work that such political betting is not permitted underneath derivatives legal guidelines and that the company does not have the flexibility to police manipulation of these markets — mainly arguing that it must be an elections cop. With solely days remaining in his chairmanship, Behnam’s company was searching for details about Polymarket’s prospects from crypto trade Coinbase.

In language that is a pointy distinction from Behnam’s resistance, Pham known as prediction markets “an vital new frontier in harnessing the facility of markets to evaluate sentiment to find out possibilities that may carry reality to the Info Age.” She added the company must “break with its previous hostility.”

Learn Extra: Polymarket’s Buyer Information Sought by CFTC Subpoena of Coinbase, Supply Says

Pham is working the company within the absence of Trump naming a everlasting nominee to hunt Senate affirmation to take over. Thus far, the president has solely picked a head for its cousin regulator, the Securities and Change Fee. Such confirmations can take months, so whether or not or not Pham turns into a frontrunner for the everlasting job, she’ll have time to perform some coverage targets on the CFTC.