[ad_1]

South Carolina’s liquor legal responsibility insurance coverage market is in disaster, with insurers dropping a mean of $1.77 for each $1.00 of premium earned since 2017, whereas declare frequencies considerably outpace neighboring states, in line with a latest research by the state’s Division of Insurance coverage.

The excellent evaluation, initiated following a 2019 request by the South Carolina Senate Judiciary Committee, reveals a deeply troubled market the place insurers are dropping cash.

“The info appear to substantiate the anecdotal assertions, made by each insurance coverage corporations and small companies, of a really troubled and challenged market,” the report acknowledged.

Present Market Panorama

The liquor legal responsibility insurance coverage market in South Carolina has maintained a comparatively secure variety of individuals lately. Since 2019, the variety of insurance coverage teams working on this sector has held regular at round 48 individuals. This consistency in market gamers suggests a mature, albeit difficult, insurance coverage atmosphere.

Regardless of the general stability in participant numbers, the market is characterised by the dominance of three main insurance coverage teams.

Premium Tendencies

Whereas the variety of market individuals has remained comparatively fixed, earned premiums have skilled exceptional progress over a five-year interval. From 2017 to 2022, earned premiums within the South Carolina liquor legal responsibility insurance coverage market greater than doubled to $17.0 million from $7.6 million.

This dramatic surge in premiums could be attributed to numerous components, however rising insurance coverage charges play an important function, the report famous.

Profitability Disaster in South Carolina

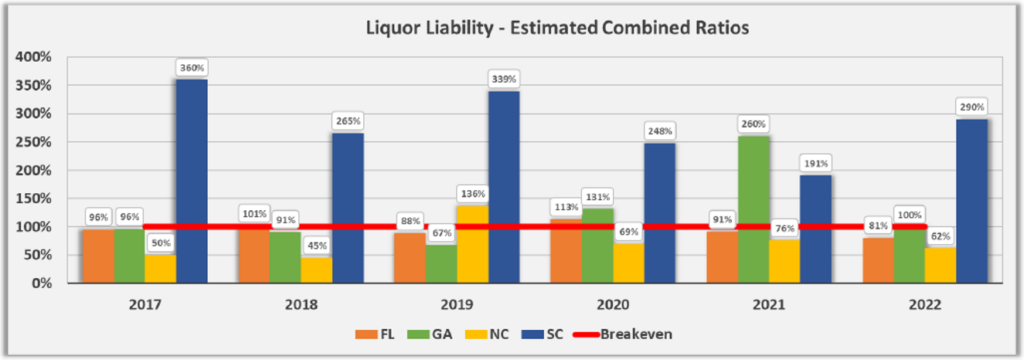

Since 2017, liquor legal responsibility insurers have misplaced about $1.77 for each $1.00 of premium earned over the six years noticed. In the most effective performing of these six years (2018), the trade misplaced roughly $0.91 per $1.00 of premiums earned, whereas dropping about $2.60 per $1.00 of premiums earned within the worst performing 12 months, 2022.

“Mixed ratios for the trade make it clear that this sub-line of insurance coverage is being written at large underwriting losses,” the report’s authors acknowledged.

The severity of South Carolina’s liquor legal responsibility insurance coverage disaster turns into much more obvious when in comparison with their neighboring states, the place these identical insurers have realized a web revenue over time, the report famous.

Over the identical 2017-2022 interval analyzed, for instance, North Carolina’s estimated liquor legal responsibility mixed ratio ranged between 45% and 76%. In 2022, when South Carolina’s estimated mixed ratio hit 290%, North Carolina’s stood at 62%.

Claims Severity and Frequency

The liquor legal responsibility insurance coverage market in South Carolina additionally has skilled vital fluctuations in declare severity over latest years. In 2022, the typical incurred declare per $1 million of earned premium reached $281,071, a considerable improve from $121,761 the earlier 12 months. This determine, nonetheless, falls inside a broader historic context of volatility. The state witnessed its highest common declare of $338,244 in 2017, adopted by a dramatic drop to $121,761 in 2021.

Regardless of these fluctuations, latest knowledge means that South Carolina’s declare severity is aligning extra carefully with neighboring states lately, in line with the report.

Whereas severity developments present indicators of alignment with regional norms, declare frequency in South Carolina presents a extra urgent problem.

From 2019 to 2022, South Carolina’s declare frequency (variety of incurred claims per $1 million of earned premium) has outpaced that noticed within the different states significantly. The claims frequency price was 9 in 2022, 13 in 2021, 10 in 2020 and 12 in 2019. Throughout that very same interval, none of its neighboring states — Florida, Georgia and North Carolina — reported a claims frequency price greater than 5.

View the complete South Carolina report right here.

[ad_2]