[ad_1]

Crypto analyst Astronomer (@astronomer_zero) posits a powerful bullish outlook for Bitcoin within the fourth quarter of 2024. Leveraging historic knowledge, Astronomer supplies an evaluation by way of X, suggesting an 82% likelihood of an extremely bullish development primarily based on the efficiency of Bitcoin in September.

The crypto analyst opens his evaluation with an emphasis on the surprising constructive efficiency of Bitcoin in September. “September is about to shut and to most people’s shock, it’s wanting prefer it’s going to be inexperienced (by a protracted shot), with the prospect of setting the greenest September in 2024, supporting our breakout thesis we have now been on for some time now,” he writes.

Delving into the sentiment of the market, Astronomer notes a major disconnect between public notion and precise market positions. “And though we’re not the one ones anymore which might be on the total bull thesis, knowledge is and stays knowledge. And after thorough inspection, regardless of the speaking/evaluation posts, most are usually not positioned but, took revenue too early or will cheer for dips and say they’re a present for the rationale of wanting one,” he defined.

Associated Studying

He additional elaborates on the sentiment inside closed circles: “This remark isn’t just coming from public posts or Twitter, but in addition from the array of paid teams partaken in to conduct these analyses. Not allowed to share names or particulars, however most teams certainly are lengthy and took revenue early, are in search of an entry, or are quick. So the market’s hand appears to be working.”

82% Probability Bitcoin Will Be Bullish

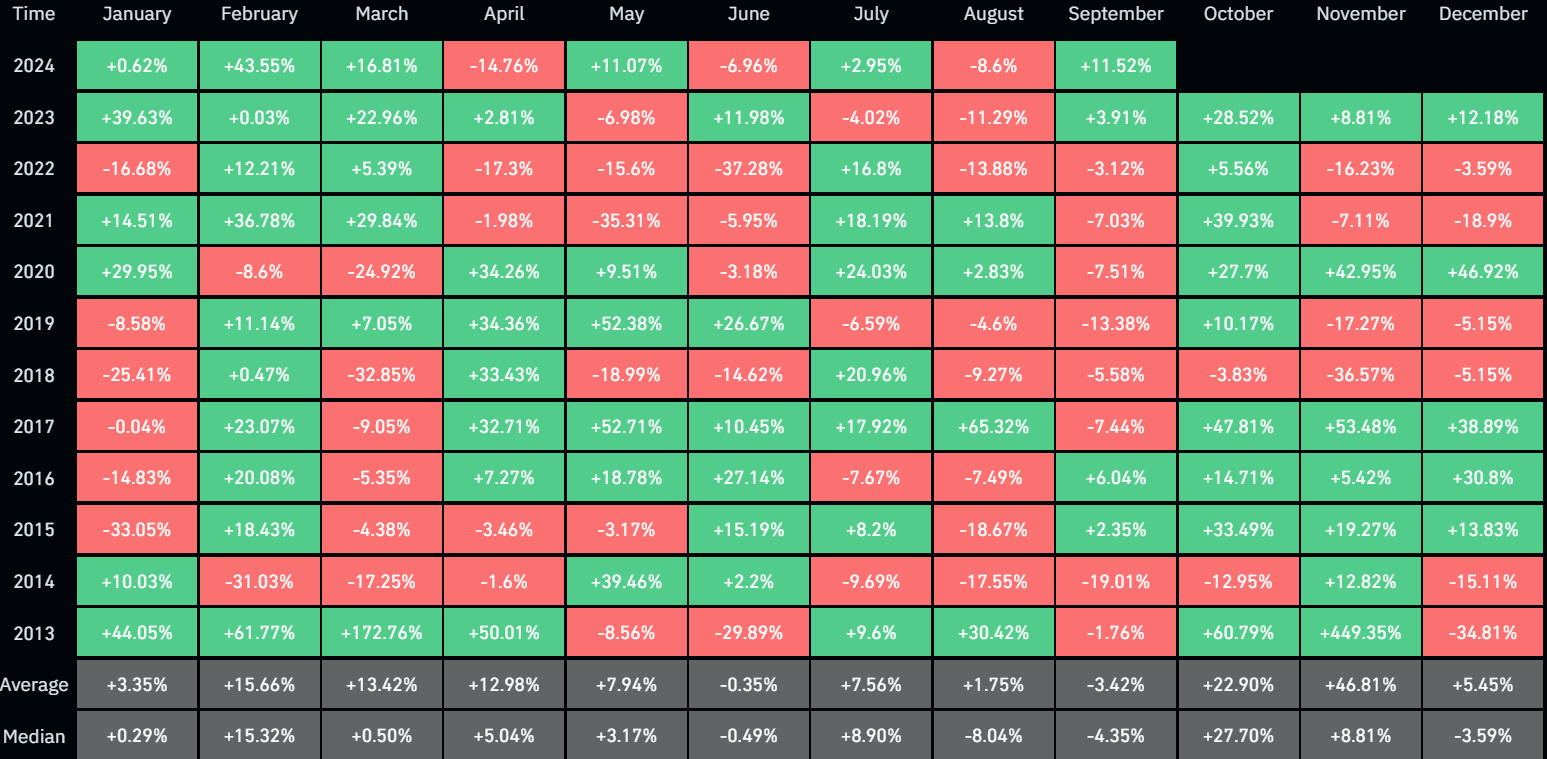

Astronomer’s bullish thesis leans on historic knowledge, significantly the cyclical nature of the Bitcoin worth. “The info evaluation is pretty easy right here: every time BTC had a inexperienced September, it was adopted by a minimum of three inexperienced months after, i.e., a inexperienced October, November, and December. And this has occurred 3/3 occasions since BTC inception,” he asserts, signifying a powerful seasonal sample.

Nevertheless, he’s fast to mood this with a critique of his methodology, admitting to the potential pitfalls of low knowledge samples: “Now like I mentioned, I’m not the largest fan of seasonality and our evaluation solely has 3 knowledge factors, which supplies us solely a 67% confidence to make the declare that the subsequent three months will certainly be inexperienced (low knowledge fallacy). However so as to add significance, by the binary nature of bullish/bearish, there’s additionally exclusivity to the information: if September just isn’t inexperienced, 6 out of 8 occasions, This fall has not been inexperienced every month.”

Associated Studying

He refines his thesis additional, “So, by together with the exclusivity, a extra normal and simpler to interpret declare, utilizing extra knowledge factors is that: ‘The path of September has decided the final path of This fall and if September is inexperienced and never crimson, a bullish (not bearish) This fall has adopted 9 out of 11 occasions. So if September closes above $59k, there’s an 82% probability This fall shall be bullish’.”

The prediction stirred dialogue throughout the neighborhood. A person @pieceofsheet99 commented skeptically, suggesting the potential for an surprising downturn: “If September turned out to be inexperienced to everybody’s shock, October may also change into crimson to everybody’s shock as properly.” Astronomer responded, reaffirming his reliance on historic developments, “Certainly, however that’s not what we have now seen sometimes. So, I personally, as all the time, follow the information.”

Astronomer’s evaluation concludes on a observe of strategic optimism, emphasizing the significance of aligning with market dynamics and historic patterns slightly than speculative impulses. “How bullish? We are going to see (time is extra vital than worth), nevertheless it’s not about planning for retirement and making quick cash. It’s about being on the fitting facet of the commerce, time after time after time, having fun with the market stress-free and never having too many regrets by dropping cash or being sidelined (having fun with the method). And this fashion, finally (slightly quickly), you hit your objectives.”

At press time, BTC traded at $64,622.

Featured picture created with DALL.E, chart from TradingView.com

[ad_2]