[ad_1]

Nordson Corp NDSN fell by 5.43% to $236.01 in after-hours on Wednesday as the corporate income steerage for the fiscal yr 2025 was beneath analyst expectations. Nonetheless, the technical evaluation utilizing easy shifting averages signifies that the inventory stays underneath strain pointing towards a bearish development.

What Occurred: Nordson recorded a web earnings of $122 million for the fourth quarter of the present fiscal, which was lower than the online earnings of $128 million in the identical quarter of the earlier fiscal yr.

The corporate which makes spraying gear for agricultural use had its web gross sales enhance by 4% year-on-year. It recorded $744 million in income for the interval, in comparison with $719 million within the prior yr’s fourth quarter.

On a full-year foundation, Nordson recorded report gross sales of $2.7 billion, reflecting 2% development over final fiscal’s report gross sales. The online earnings for the yr was $467 million, a lower from the prior yr’s web earnings of $487 million.

Nordson income steerage for the upcoming fiscal 2025 was between $2.75 billion and $2.87 billion, which was beneath analysts’ expectations of $2.93 billion, based on information compiled by LSEG.

Additionally learn: Earnings Abstract: Nordson This autumn

Why It Issues: Nordson Corp’s inventory has declined by 3.52% on a year-to-date foundation and superior by 7.23% within the final six months. This compares to a 31.55% and 11.81% efficiency by the Nasdaq 100 Index in the identical interval, respectively.

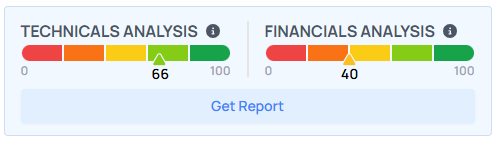

From a technical perspective, the evaluation of each day shifting averages signifies that the inventory could also be underneath strain.

The inventory ended at $236.01 in after-hours on Wednesday. This was beneath its eight and 20-day easy shifting averages, of $255.12 and $256.39, respectively. As per Benzinga Professional information, its present inventory value was additionally decrease than the 50 and 200-day shifting common costs at $255.04 and $251.99, respectively.

This development signifies that the inventory is experiencing a bearish divergence. The inventory value might be making an attempt to get well however the momentum just isn’t robust sufficient to push it above the shifting averages. Alternatively, the relative energy index of 39.44 suggests the inventory is close to the oversold territory.

Benzinga’s technical evaluation scorecard, scores the corporate at 66 factors on 100.

What Are Analysts Saying: In response to Benzinga, Nordson has a consensus value goal of $275.29 based mostly on the rankings of eight analysts. The best value goal out of all of the analysts tracked by Benzinga is $315 issued by DA Davidson as of Feb. 27, 2024. The bottom goal value is $225 issued by Loop Capital on March 21, 2023.

The common value goal of $284.67 between two adjustments from Baird, and DA Davidson implies a 20.62% upside for Nordson.

Picture by way of Nordson

Learn Subsequent:

Market Information and Information dropped at you by Benzinga APIs

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.

[ad_2]