[ad_1]

5 analysts have shared their evaluations of Terreno Realty TRNO throughout the latest three months, expressing a mixture of bullish and bearish views.

The desk beneath affords a condensed view of their latest scores, showcasing the altering sentiments over the previous 30 days and evaluating them to the previous months.

| Bullish | Considerably Bullish | Detached | Considerably Bearish | Bearish | |

|---|---|---|---|---|---|

| Whole Scores | 0 | 2 | 3 | 0 | 0 |

| Final 30D | 0 | 0 | 1 | 0 | 0 |

| 1M In the past | 0 | 1 | 2 | 0 | 0 |

| 2M In the past | 0 | 1 | 0 | 0 | 0 |

| 3M In the past | 0 | 0 | 0 | 0 | 0 |

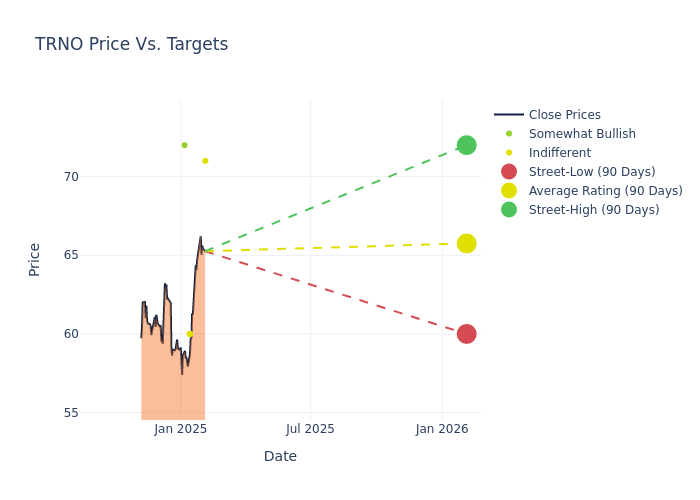

Analysts have set 12-month worth targets for Terreno Realty, revealing a mean goal of $67.0, a excessive estimate of $72.00, and a low estimate of $60.00. Observing a downward pattern, the present common is 5.19% decrease than the prior common worth goal of $70.67.

Deciphering Analyst Scores: An In-Depth Evaluation

The standing of Terreno Realty amongst monetary specialists turns into clear with a radical evaluation of latest analyst actions. The abstract beneath outlines key analysts, their latest evaluations, and changes to scores and worth targets.

| Analyst | Analyst Agency | Motion Taken | Score | Present Value Goal | Prior Value Goal |

|---|---|---|---|---|---|

| John Kim | BMO Capital | Broadcasts | Market Carry out | $71.00 | – |

| Omotayo Okusanya | Deutsche Financial institution | Broadcasts | Maintain | $60.00 | – |

| Brendan Lynch | Barclays | Lowers | Equal-Weight | $60.00 | $68.00 |

| Mitch Germain | JMP Securities | Maintains | Market Outperform | $72.00 | $72.00 |

| Mitch Germain | JMP Securities | Maintains | Market Outperform | $72.00 | $72.00 |

Key Insights:

- Motion Taken: In response to dynamic market circumstances and firm efficiency, analysts replace their suggestions. Whether or not they ‘Preserve’, ‘Increase’, or ‘Decrease’ their stance, it signifies their response to latest developments associated to Terreno Realty. This perception provides a snapshot of analysts’ views on the present state of the corporate.

- Score: Providing insights into predictions, analysts assign qualitative values, from ‘Outperform’ to ‘Underperform’. These scores convey expectations for the relative efficiency of Terreno Realty in comparison with the broader market.

- Value Targets: Delving into actions, analysts present estimates for the long run worth of Terreno Realty’s inventory. This evaluation reveals shifts in analysts’ expectations over time.

Assessing these analyst evaluations alongside essential monetary indicators can present a complete overview of Terreno Realty’s market place. Keep knowledgeable and make well-judged selections with the help of our Scores Desk.

Keep updated on Terreno Realty analyst scores.

Get to Know Terreno Realty Higher

Terreno Realty Corp is an actual property funding belief engaged in buying, proudly owning, and working industrial actual property in six coastal U.S. markets: Los Angeles, Northern New Jersey/New York Metropolis, San Francisco Bay Space, Seattle, Miami, and Washington, D.C. The corporate invests in a number of sorts of industrial actual property, together with warehouse/distribution, flex (together with gentle industrial and analysis and improvement), transshipment, and improved land.

Key Indicators: Terreno Realty’s Monetary Well being

Market Capitalization Evaluation: The corporate displays a decrease market capitalization profile, positioning itself beneath trade averages. This implies a smaller scale relative to friends.

Income Development: Terreno Realty’s income development over a interval of three months has been noteworthy. As of 30 September, 2024, the corporate achieved a income development charge of roughly 20.16%. This means a considerable enhance within the firm’s top-line earnings. Compared to its trade friends, the corporate stands out with a development charge larger than the typical amongst friends within the Actual Property sector.

Web Margin: Terreno Realty’s web margin surpasses trade requirements, highlighting the corporate’s distinctive monetary efficiency. With a powerful 36.62% web margin, the corporate successfully manages prices and achieves robust profitability.

Return on Fairness (ROE): Terreno Realty’s ROE stands out, surpassing trade averages. With a powerful ROE of 1.03%, the corporate demonstrates efficient use of fairness capital and robust monetary efficiency.

Return on Belongings (ROA): Terreno Realty’s monetary power is mirrored in its distinctive ROA, which exceeds trade averages. With a outstanding ROA of 0.81%, the corporate showcases environment friendly use of belongings and robust monetary well being.

Debt Administration: The corporate maintains a balanced debt strategy with a debt-to-equity ratio beneath trade norms, standing at 0.19.

Analyst Scores: Simplified

Scores come from analysts, or specialists inside banking and monetary methods that report for particular shares or outlined sectors (usually as soon as per quarter for every inventory). Analysts normally derive their data from firm convention calls and conferences, monetary statements, and conversations with essential insiders to achieve their selections.

Analysts might complement their scores with predictions for metrics like development estimates, earnings, and income, providing traders a extra complete outlook. Nevertheless, traders must be conscious that analysts, like all human, can have subjective views influencing their forecasts.

Which Shares Are Analysts Recommending Now?

Benzinga Edge provides you prompt entry to all main analyst upgrades, downgrades, and worth targets. Kind by accuracy, upside potential, and extra. Click on right here to remain forward of the market.

This text was generated by Benzinga’s automated content material engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.

[ad_2]