In response to Goldman Sachs, Bitcoin (BTC) worth appreciation in 2024 didn’t compensate for its worth volatility dangers. In the meantime, gold’s larger risk-adjusted returns reaffirmed its “secure haven” narrative.

Regardless of The Good points, Bitcoin Fails To Outshine Gold

The main digital asset by reported market cap surged from roughly $42,000 at first of the 12 months to as excessive as $73,000 in March 2024, recording greater than 73% positive factors. At its present market worth of $62,790, BTC continues to be greater than 40% up from its worth in January 2024.

Associated Studying

Notably, all through 2024, Bitcoin has constantly outperformed main fairness indices, fixed-income devices, gold, and crude oil.

Nevertheless, based on knowledge tracked by Goldman Sachs, regardless of BTC’s spectacular positive factors, its worth efficiency in absolute phrases fails to compensate for its volatility.

The evaluation by Goldman Sachs places BTC’s year-to-date (YTD) volatility ratio at slightly below 2%. As compared, gold gave a risk-adjusted return of three%, posting robust 28% positive factors in absolute phrases.

For the uninitiated, the volatility ratio measures the return an asset generates for every unit of danger or volatility it carries. A better ratio signifies that an asset offers higher returns relative to the danger taken, whereas a decrease ratio suggests much less environment friendly efficiency.

The evaluation notes that Bitcoin’s volatility ratio was solely higher than Ethereum’s native ETH token, S&P GSCI Vitality Index, and Japan’s TOPIX index among the many non-fixed revenue growth-sensitive investments.

Bitcoin’s low volatility ratio in comparison with gold cements the latter’s declare as a “secure haven asset.” This got here beneath the limelight final week when BTC slumped, and gold surged following Iran’s offensive towards Israel.

Nonetheless A Lengthy Manner To Go For Bitcoin

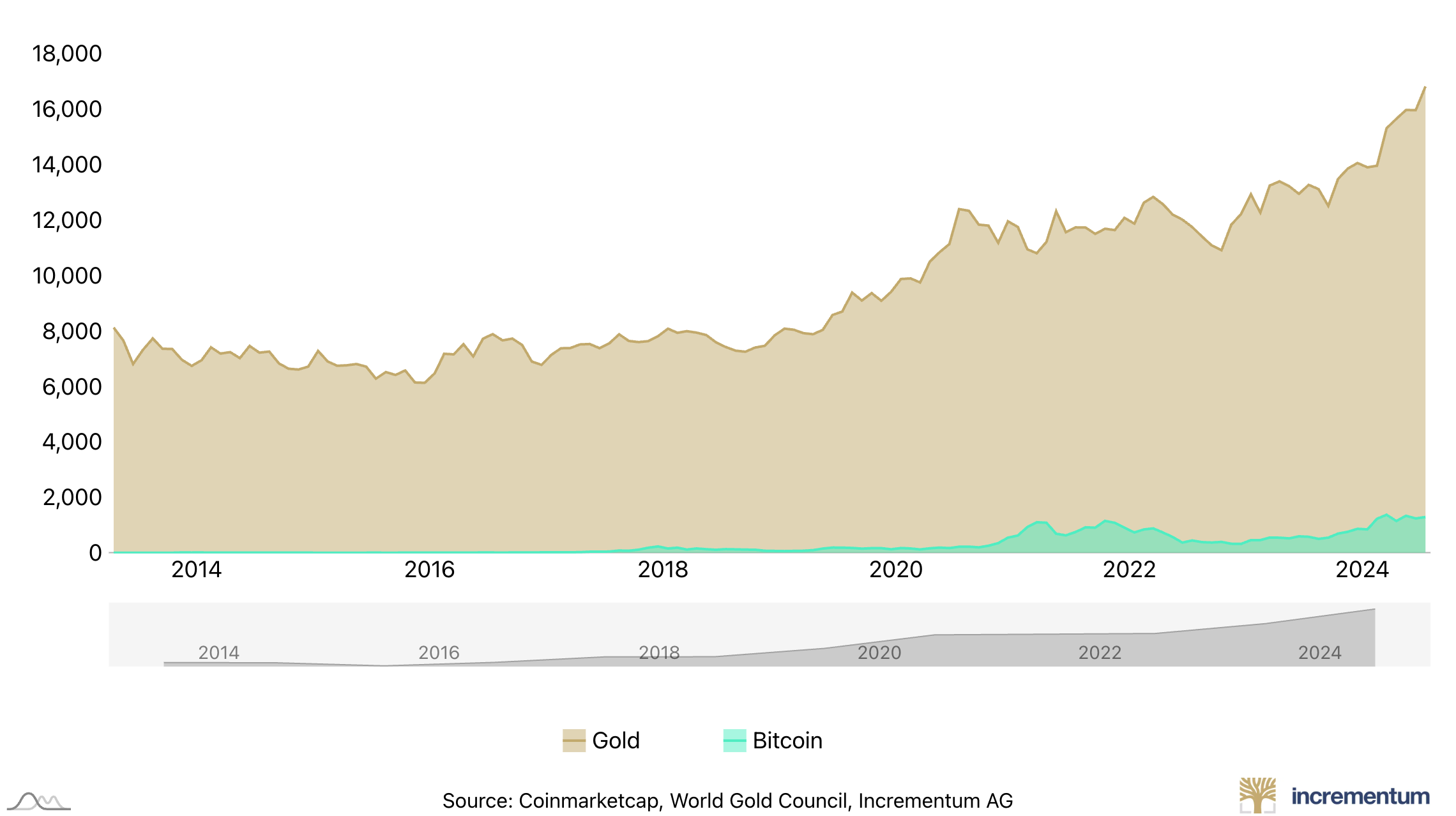

Since its inception following the 2008 monetary disaster, Bitcoin’s ascent to a trillion-dollar market cap asset has been outstanding.

The mounted provide of 21 million, decentralized community structure, and halving each 4 years make BTC an interesting asset. Nevertheless, the market cap hole between Bitcoin and gold stays huge.

That stated, a number of crypto analysts are assured that Bitcoin will outperform the shining metallic within the coming years. As an illustration, seasoned analyst Peter Brandt lately made an formidable prediction that by 2025, BTC might see its worth bounce 400% relative to gold.

Associated Studying

Equally, in August 2024, VanEck CEO Jan van Eck said that BTC might surge to $350,000 on the again of better adoption.

Most lately, funding administration agency BlackRock declared Bitcoin a “gold different” as a consequence of its mounted provide and growing investor confidence in its potential to deal with inflation and keep away from worth erosion throughout unsure instances.

Quite the opposite, billionaire Ray Dalio has expressed his opinion on the Bitcoin vs. gold narrative, saying that BTC won’t ever absolutely substitute gold. BTC trades at $62,790 at press time, down 2.3% within the final 24 hours.

Featured picture from Unsplash, charts from ingoldwetrust.report and Tradingview.com