[ad_1]

Every week, Benzinga’s Inventory Whisper Index makes use of a mixture of proprietary knowledge and sample recognition to showcase 5 shares which are slightly below the floor and deserve consideration.

Traders are continually on the hunt for undervalued, under-followed and rising shares. With numerous strategies out there to retail merchants, the problem usually lies in sifting by way of the abundance of data to uncover new alternatives and perceive why sure shares needs to be of curiosity.

Learn Additionally: EXCLUSIVE: High 20 Most-Searched Tickers On Benzinga Professional In 2024 — The place Do Tesla, Nvidia, GameStop, Trump Media Shares Rank?

Here is a have a look at the Benzinga Inventory Whisper Index for the week ending Jan. 31:

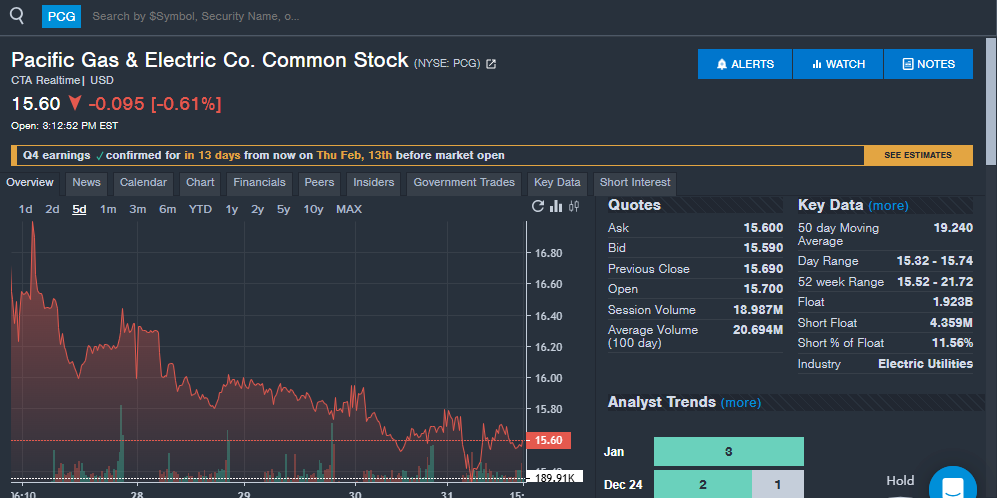

Pacific Fuel & Electrical Co PCG: The utility firm noticed robust curiosity from readers through the week, which comes as fourth-quarter monetary outcomes are approaching. The corporate is ready to report This fall outcomes on Feb. 13. Analysts anticipate the corporate to report earnings per share of 31 cents, down from 47 cents within the prior 12 months’s fourth quarter and income of $7.11 billion, up from $7.04 billion within the comparable interval. The corporate has overwhelmed analyst earnings per share estimates in 4 straight quarters. On the income facet, the corporate has overwhelmed analyst estimates in solely 4 of the final 10 quarters. A number of analysts saved bullish rankings on the inventory whereas decreasing value targets.

The inventory was down over 5% for the week and shares are down over 7% during the last 12 months.

Interactive Brokers Group IBKR: The web buying and selling firm noticed robust curiosity from readers, which might be associated to a number of analyst rankings in latest weeks. UBS maintained a Purchase ranking and raised the value goal from $225 to $265. Interactive Brokers may even be presenting at the united statesFinancial Providers Convention on Feb. 10. Goldman Sachs analyst James Yaro maintained a Purchase ranking on Interactive Brokers and raised the value goal from $214 to $226. The analyst stated Interactive Brokers’ fourth-quarter monetary outcomes confirmed the corporate was “well-rounded.”

“Trying forward, the corporate expects to conduct quite a few new programming initiatives, and plans to extend the advertising finances, each of which ought to help robust account progress, round which administration sounded a constructive tone,” Yaro stated.

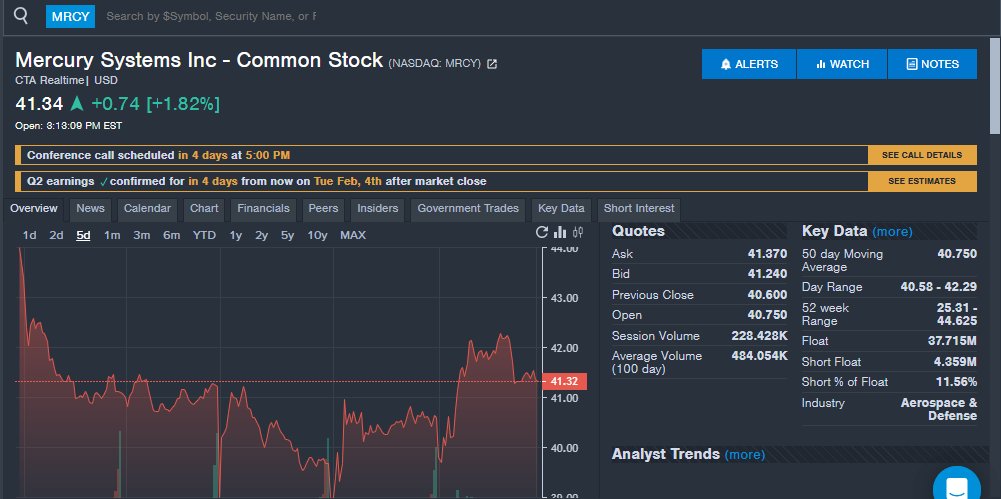

Mercury Methods MRCY: The aerospace and protection inventory noticed robust curiosity from readers, which comes forward of second-quarter monetary outcomes set for Feb. 4. Analysts anticipate the corporate to report a lack of 4 cents per share and income of $182.4 million within the quarter. After struggling in previous quarters, the corporate has overwhelmed analyst estimates for each income and earnings per share within the final two quarters. The inventory might have seen elevated curiosity from readers as the corporate introduced a brand new $24.5 million contract for knowledge processing within the U.S. Satellite tv for pc Program.

“We’re proud to help this important U.S. nationwide safety mission,” Mercury Methods Vice President of Mercy’s Superior Ideas Group Joe Plunkett stated. “The Mercury Processing Platform has an unbelievable breadth of capabilities that may be built-in in nearly limitless methods to allow mission-critical processing on the edge.”

The inventory was down 2% on the week and is up round 40% during the last 12 months.

Xometry Inc XMTR: The AI-enabled manufacturing firm noticed robust curiosity from readers through the week. The curiosity comes as a number of analysts have shared updates on the small-cap inventory in latest weeks and with a brand new government announcement. The corporate added Sanjeev Singh Sahni, a former Wayfair government, within the newly created President function. Within the function, Sahni will lead international operations, product, expertise and provider companies. JMP Securities maintained a Purchase ranking on the inventory with a $42 value goal lately. Earlier this month, JPMorgan analyst Cory Carpenter shared a $45 value goal on the inventory, highlighting the corporate as a small-cap darling.

“We like XMTR in 2025 as a play on manufacturing beneath Trump,” Carpenter stated.

The analyst stated the corporate has catalysts that embody worldwide growth and a “variety of methods to win in 2025.”

Costco Wholesale Company COST: Rounding out this week’s Inventory Whisper Index is retailer Costco, which continues to see robust curiosity from readers with shares close to all-time highs. The corporate reported robust December web gross sales of $27.52 billion, up 9.9% year-over-year lately. Costco additionally made headlines for changing Pepsi fountain drinks in its shops with Coca-Cola whereas committing to maintain the value of the well-known $1.50 sizzling canine combo in place. The corporate can also be making headlines for defending its DEI insurance policies and growing non-union employee wages to $30 per hour for many U.S. retailer staff.

Keep tuned for subsequent week’s report, and comply with Benzinga Professional for all the most recent headlines and high market-moving tales right here.

Learn the most recent Inventory Whisper Index studies right here:

Learn Subsequent:

Market Information and Information dropped at you by Benzinga APIs

© 2025 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.

[ad_2]