The regulation apply administration platform MyCase rolled out three product updates in the present day that embrace MyCaseIQ, an AI conversational interface; enhancements to its accounting module; and an immigration add-on. It additionally introduced the beta launch of Sensible Spend, a product that marries a enterprise bank card to expense monitoring inside MyCase.

Generative AI Enhancements

Final January, AffiniPay, the mother or father firm of MyCase, introduced AffiniPay IQ, its strategic initiative to embed generative synthetic intelligence throughout all of its merchandise and make AI a local part of authorized professionals’ every day workflows, together with the beta variations of the primary two options of that initiative, doc summarization and textual content modifying.

Now, these two options are popping out of beta below the identify MyCase IQ. The textual content modifying characteristic is already out of beta and accessible inside MyCase, and doc summarization will launch inside a couple of weeks.

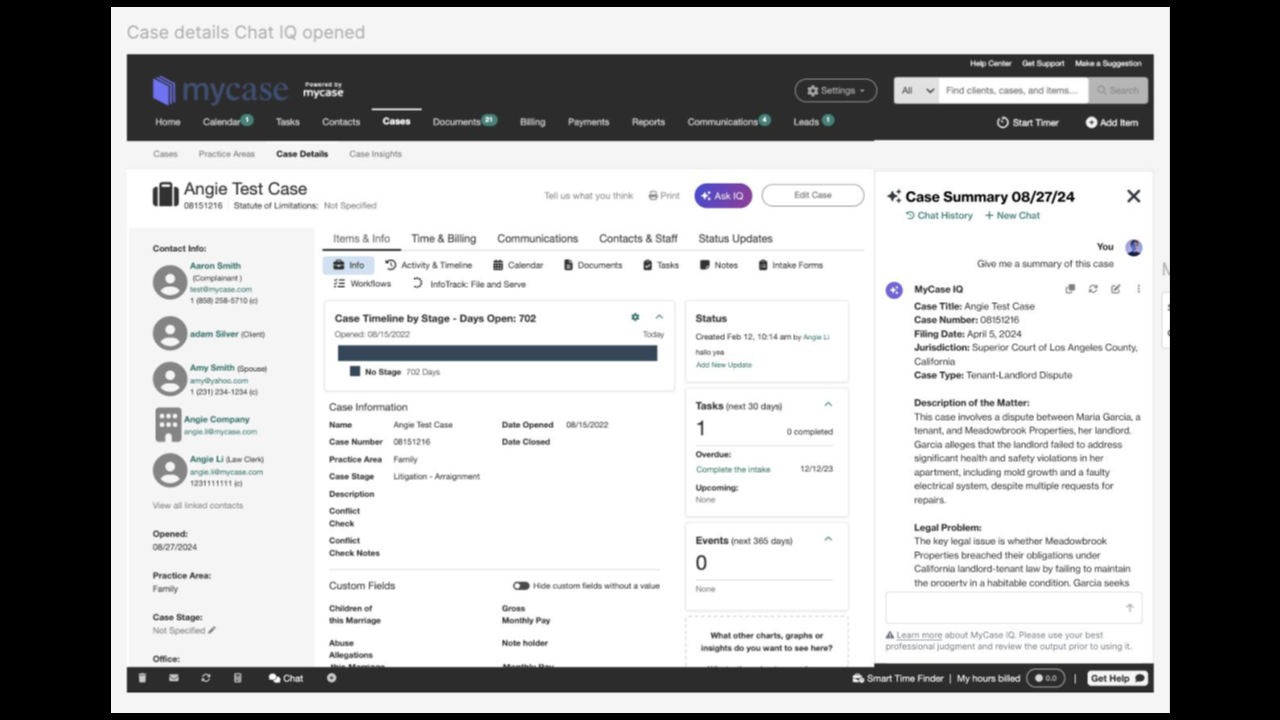

As well as, early subsequent yr, MyCase will launch an AI-driven conversational interface will enable customers to supply case info, timelines, and information, all inside the case file itself, by asking questions in a conversational type.

The interface will likely be embedded straight within the case element web page. It should have instructed prompts that customers can choose, reminiscent of to request a abstract of the case or an in depth timeline.

“We’re on a mission to make our purchasers financially properly, and to make use of innovative expertise to attain that objective in partnership with them,” Dru Armstrong, chief govt officer of AffiniPay, mother or father firm of MyCase, advised me throughout a briefing yesterday.

“So our entire thesis for generative AI is to not do it as a result of everybody’s doing it, however to do it as a result of it makes corporations have the ability to leverage automation and intelligence to present them time again to allow them to serve their purchasers.”

From beta testing these generative AI options, Armstrong stated, one main takeaway has been that attorneys actually need to belief the accuracy of the data the AI is offering.

“So we’ve accomplished a whole lot of work to guarantee that every thing that goes full GA [general availability] meets these very excessive requirements that our attorneys have,” she stated.

Accounting Enhancements

MyCase additionally in the present day launched enhancements to its native accounting software program. Amongst these enhancements:

- 1099 vendor reporting: To assist simplify bookkeeping, MyCase Accounting will quickly supply 1099 vendor reporting straight inside the platform.

- Computerized deposit slip creation: MyCase accounting now affords automated deposit slip creation for distributors. When funds are deposited into the agency’s checking account, the slip is created mechanically.

- Computerized financial institution reconciliation: As soon as the deposit slip is created, it’s matched to the corresponding financial institution feed transaction from LawPay, eliminating the typically time-consuming activity of reconciling deposit slips and transactions.

The deposit slip characteristic is obtainable now, and the opposite enhancements will likely be rolled out between now and the primary quarter of subsequent yr.

Armstrong stated the financial institution reconciliation is especially highly effective for its capacity to resolve a core apply administration problem of IOLTA compliance by combining invoicing inside MyCase, digital funds by way of LawPay, which can be owned by AffiniPay, and automated reconciliation inside the native accounting characteristic.

“When you have got MyCase with the bill and billing engine mixed with LawPay, after which having the authorized accounting bundle constructed natively within the platform, it actually makes it a fairly automagical expertise to have the ability to reconcile the invoices with the transactions with the checking account,” she stated.

Immigration Add-On

The immigration add-on makes use of an software programming interface (API) to attach MyCase with its sibling firm Docketwise, a case administration platform for immigration legal professionals.

The add-on integrates immigration case administration into the MyCase apply administration platform, enabling immigration attorneys to get the advantages of each case administration and apply administration with out having to change between platforms.

Armstrong stated that many immigration clients wished extra of a full apply administration platform, whereas conserving the immigration-specific case administration options of Docketwise, reminiscent of its Sensible Varieties.

Ever since AffiniPay acquired MyCase, which already owned Docketwise, bringing collectively the capabilities of the 2 platforms “had been a core a part of our imaginative and prescient,” Armstrong stated.

To make the most of the mixing, MyCase customers will required to buy a subscription for the Docketwise add-on. The month-to-month value of the add-on will likely be $79 per consumer or $69 if bought yearly.

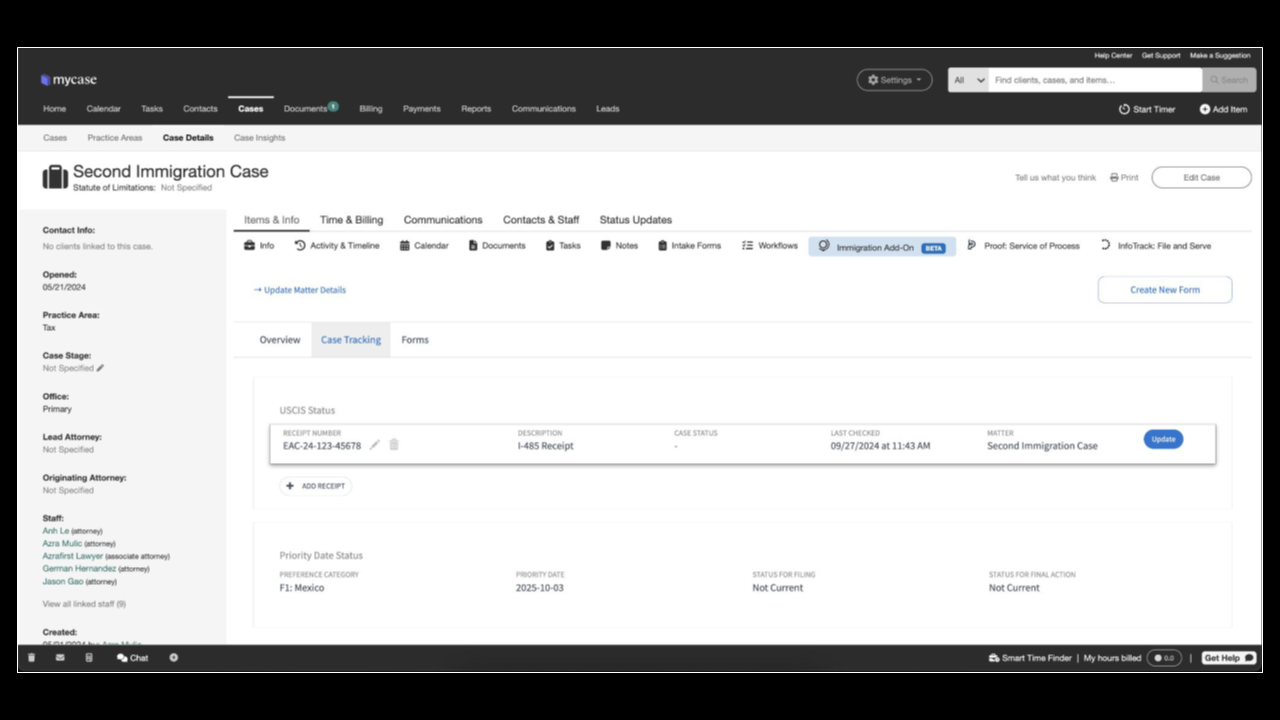

As soon as bought, all Docketwise options will likely be accessible straight inside MyCase, with out having to change platforms and even ever use the Docketwise platform. Among the many options the add-on offers:

- Sensible Varieties: Customers can auto-populate immigration types with shopper information, eliminating guide entry.

- USCIS case monitoring: Monitor the standing of immigration instances by means of automated USCIS updates, conserving attorneys and purchasers knowledgeable, from inside MyCase.

- E-filing: Allows digital submission of immigration types on to authorities companies (USCIS, DOL FLAG, DOS CEAC) from inside MyCase.

- Precedence date monitoring: Displays key dates to make sure well timed actions are taken on immigration instances, minimizing the danger of missed deadlines.

The immigration add-on is being soft-launched earlier than the tip of the yr and will likely be made typically accessible to all customers someday subsequent yr.

Sensible Spend Beta

MyCase additionally stated in the present day that the Sensible Spend characteristic it introduced final February will turn into accessible for beta testing by choose clients staring Oct. 21. It is going to be launched for normal availability within the first quarter of subsequent yr.

MyCase had initially stated it will be launched in beta within the second quarter of this yr after which to normal launch within the third quarter.

The Sensible Spend characteristic guarantees to supply a enterprise bank card for regulation corporations that’s tied to software program that straight channels client-related bills into the related issues and invoices inside the MyCase platform.

It offers regulation corporations with a LawPay-branded Visa bank card for his or her attorneys and workers. All spending on the cardboard is tracked to a dashboard the place the agency can monitor all of its enterprise and shopper bills.

Spending can be built-in inside MyCase, so shopper bills are straight tracked to the matter, together with the character and class of the expense and any related receipts.

‘Huge Strikes’ Forward

In July, it was introduced that Genstar Capital had made a big funding in AffiniPay, whereas TA Associates, which had been the corporate’s largest investor since 2020, would proceed to retain a “significant stake” within the firm.

Throughout our briefing yesterday, Armstrong stated that she was “tremendous excited” in regards to the new investor, which now owns the bigger share of the corporate.

“They’re an exceptional software program investor with simply an incredible observe report of serving to construct best-in-class, high-growth software program companies,” she stated.

She stated the driving power behind the deal was to have the ability to make investments extra in product analysis and improvement with a purpose to ship extra for the corporate’s clients.

“It’s giving us a chance to assume extra strategically about our place available in the market,” Armstrong stated.

“We had been tremendous profitable with our MyCase acquisition, and I believe you’re going to see us making some huge strikes, whether or not it’s in merchandise that we’ve constructed or merchandise that we’ve partnered with or merchandise that we purchased.”