This Fundrise overview will study how the platform works and overview its professionals and cons.

Fundrise permits non-accredited buyers to spend money on personal actual property funds with preliminary investments as little as $10. The corporate has lately expanded to incorporate personal fairness and personal credit score investments.

Professionals

No accredited investor requirement.

Minimal investments as little as $10.

A number of fund varieties can be found.

Cons

Investments require cautious evaluation

How It Works

Fundrise made its popularity by providing actual property funds to smaller buyers who aren’t eligible for funds restricted to accredited buyers.

The corporate has launched new choices and now affords funds in 4 technique classes.

- Actual property funds provide a number of packages combining a spread of actual property asset courses, serving a number of funding methods.

- Personal credit score is an funding technique pooling funds to lend to corporations, capitalizing on the excessive rate of interest setting to ship sturdy fixed-income returns.

- Enterprise capital is a brand new funding technique for Fundrise, providing buyers publicity to a spread of pre-IPO corporations with out the restrictions that always apply to personal buyers.

- Retirement accounts embody each standard and Roth IRAs.

Fundrise is constructing from its base in actual property to develop a completely built-in platform for investing in different property. The corporate at present manages over 20 totally different funds, and buyers can select amongst them.

📱 Study extra: Unlock the potential of property funding with our overview of the 5 greatest actual property funding apps for 2024.

Funds are accessible to personal buyers who beforehand had little entry to those asset courses, with minimal investments as little as $10.

Fundrise at present has over 393,000 lively buyers. The overall portfolio holdings are over $7 billion, and Fundrise has paid out over $344 million in dividends to buyers.

Investor communication is a precedence, and buyers can count on actual time efficiency reporting, frequent analyses of financial traits affecting Fundrise portfolios, updates on portfolio modifications, and different supplies designed to reinforce transparency.

Fundrise affords a number of funding tiers with totally different minimal investments and totally different options.

| Plan | Minimal Funding | Options |

|---|---|---|

| Starter | $10 | Minimal customization, makes use of mounted portfolios |

| Primary | $1000 | Permits funding through IRAs |

| Core | $5000 | Full customization and entry to a devoted investor relations crew. Accredited buyers solely. |

| Superior | $10,000 | Entry to personalized methods |

| Premium | $100,000 | Minimal customization makes use of mounted portfolios |

Every of those accommodates a number of of the Fundrise fund choices. The distinction is within the minimal funding and within the investor’s capability to tailor the portfolio to satisfy private preferences and necessities.

📈 Study extra: Start your journey into property funding by exploring our six prime methods on the right way to begin investing in actual property.

Learn how to Make investments

Fundrise affords an very simple funding course of. You open an account, fund it, and choose your funding technique, funding aim, and tier.

From there, Fundrise will handle your portfolio for you, providing solutions and updates, or you’ll design your individual portfolio when you’ve got chosen one of many extra customizable tiers.

The Fundrise website will get typically excessive marks for being informative and straightforward to navigate.

Let’s take a more in-depth take a look at what Fundrise affords in its numerous asset courses.

Actual Property

Fundrise affords a number of actual property funding plans, differentiated by the combo of income-focused and growth-focused property in every fund.

- Supplemental earnings funds are designed to supply constant dividends over the lifetime of the fund however could have decrease long-term appreciation.

- Balanced investing funds are extremely diversified and place an equal weight on earnings and development.

- Lengthy-term development funds will generate dividends however place a better precedence on growth-focused property.

Fundrise calls their actual property funds eReits, and they’re structured as Actual Property Funding Trusts (REITs). The principle distinction between Fundrise eREITS and public REITs is that public REITs are liquid: they commerce on public exchanges and may be offered at any time.

The funds managed by Fundrise don’t commerce on an alternate and are thought-about illiquid. You’ll be able to’t simply promote any time you need to. There could also be a ready interval for redemption – redemptions usually happen on the finish of every quarter – and a few funds could have early withdrawal penalties.

Fundrise advises that its actual property funds ought to be thought-about long-term investments. Buyers shouldn’t commit funds that they don’t seem to be prepared to tie up for 5 years or extra.

Fundrise affords an distinctive vary of actual property property, together with the next:

- 8,962 multifamily residences in 10 US markets.

- 2,310,800 sq. toes of leased industrial house.

- 3,471 single-family residences in 30 US markets.

Fundrise additionally has 296 lively actual property tasks and 147 accomplished tasks. These tasks are divided into 4 classes with rising threat ranges.

- Fastened earnings investments generate rapid money movement with an anticipated 6% to eight% annual return.

- Core Plus investments take 6-12 months to ship yield, however count on to ship 8% to 10% annualized yield, with a barely greater threat profile.

- Worth Add is a method of buying undervalued property and investing extra capital to extend their worth. Time to money movement is 12-18 months, and projected returns are 10% to 12%.

- Opportunistic investments carry the very best threat. They might take 2-3 years to first money movement however are anticipated to generate 12% to fifteen% returns on an annualized foundation.

All figures for anticipated return are projections, not commitments.

A Fundrise portfolio can include a mixture of these property tailor-made to suit the consumer’s threat tolerance and funding technique.

The variety of totally different methods and asset varieties may be complicated, however that selection additionally affords a really excessive stage of diversification for the scale of the investments concerned and affords the flexibility to assemble many alternative portfolio varieties.

🏢 Study extra: Discover the top-performing market alternatives with our information to the greatest actual property shares & ETFs accessible at present.

Personal Credit score

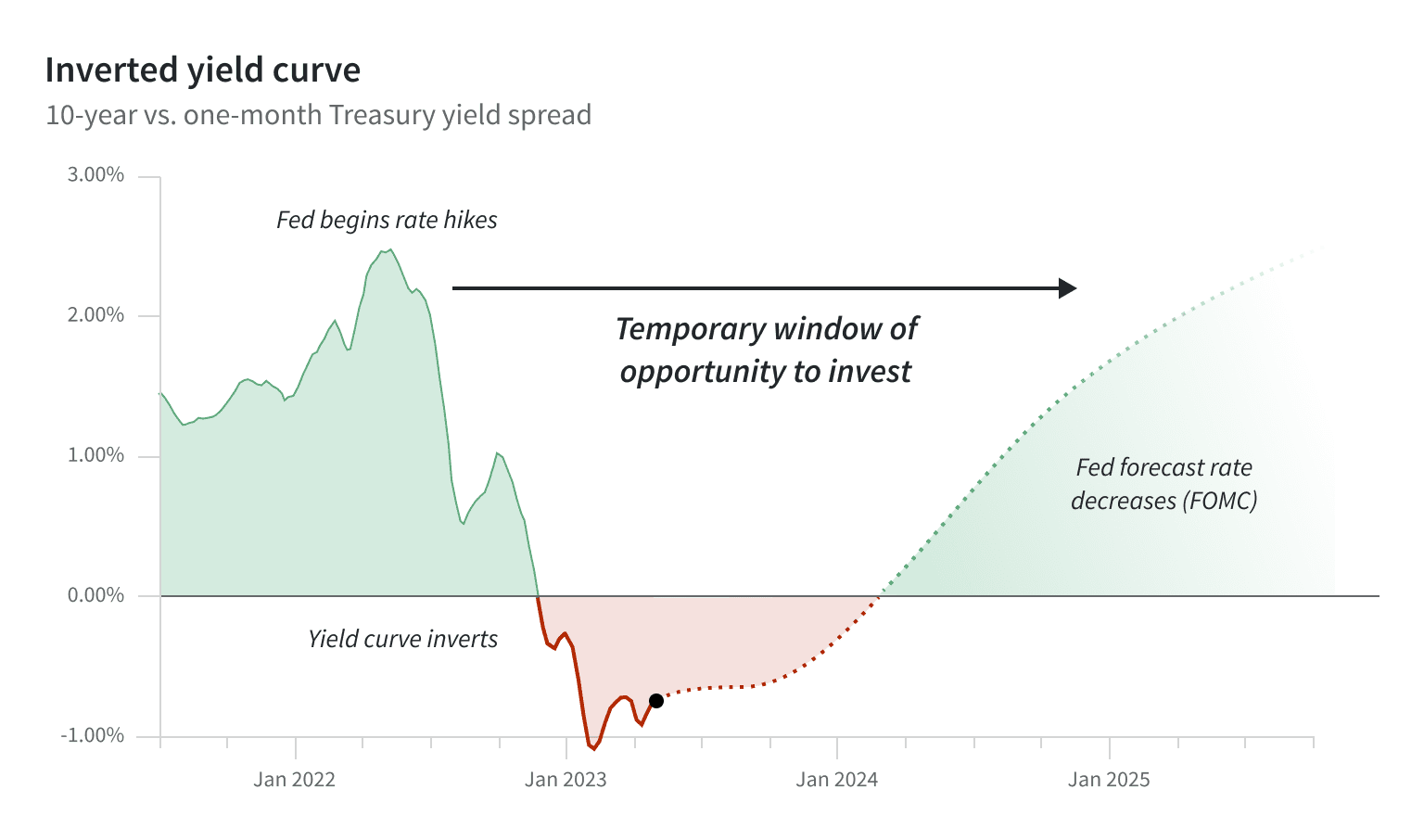

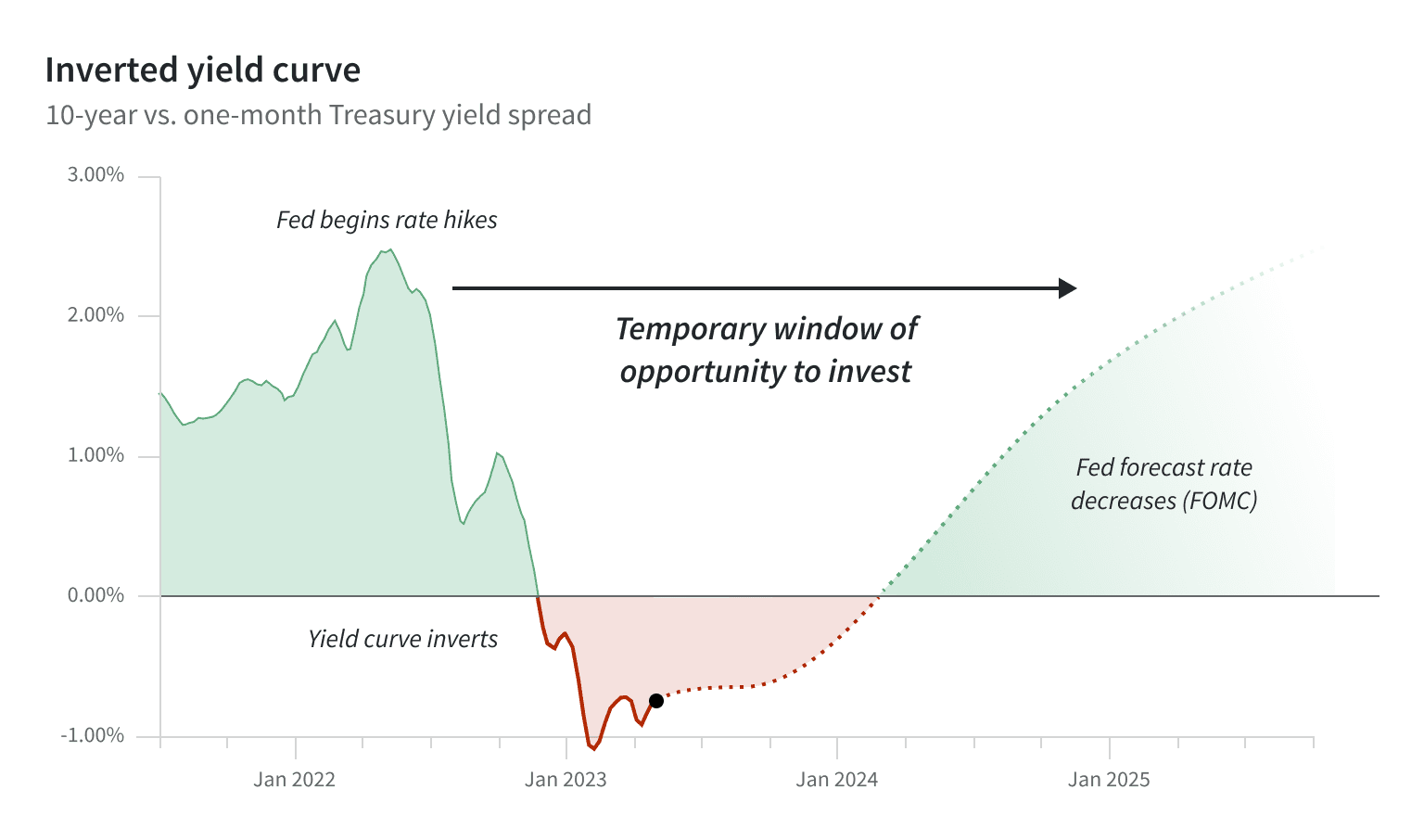

Fundrise has launched a personal credit score fund, which the corporate describes as “an opportunistic technique for income-focused buyers. The technique is predicated on the truth that brief time period loans at present carry greater rates of interest than long-term loans.

The fund is designed to capitalize on the present excessive rate of interest setting by pooling investor funds and lending them to corporations. Fundrise is leveraging its actual property expertise by lending particularly for actual property tasks.

The fund at present has $516 million in capital deployed in 90 debt offers masking actual property tasks with 20,194 items at a median rate of interest of 10.8%. It delivered a 13% annualized return in its first quarter[1].

This technique is designed to be non permanent and can solely be viable whereas rates of interest stay excessive. Fundrise doesn’t count on this example to final past 2024.

Enterprise Capital

Funding in privately held expertise corporations has historically been restricted to enterprise capital corporations and well-heeled angel buyers. Fundrise goals to upset that establishment with a enterprise capital fund that’s accessible to any investor.

Referred to as the innovation fund, this funding car focuses on high-growth personal corporations, primarily within the tech sector. The fund primarily invests in 4 classes.

- Fashionable knowledge infrastructure

- Synthetic intelligence and machine studying

- Improvement operations

- Monetary expertise

The fund at present has over 35,000 buyers, with over $100 million invested in 19 personal corporations.

As with every enterprise capital fund, earnings are solely gained when the businesses held go public or are acquired. Buyers ought to be ready to carry the fund for a medium-term to long-term time-frame.

Previous Efficiency

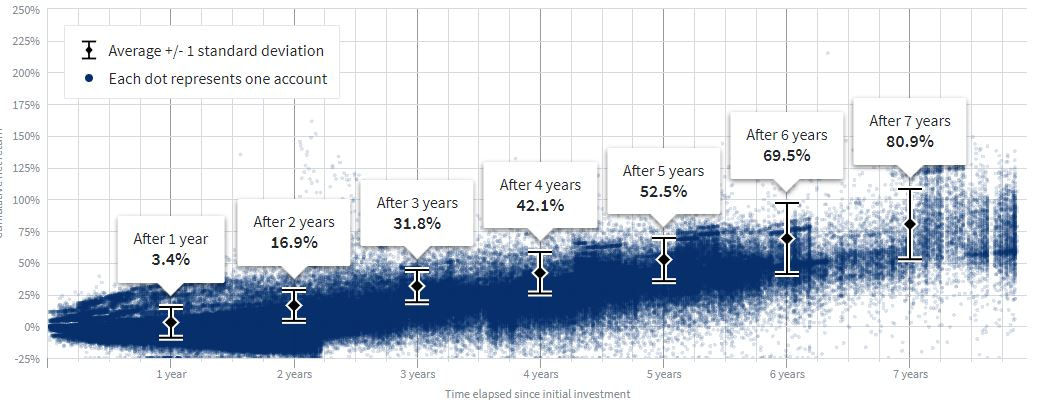

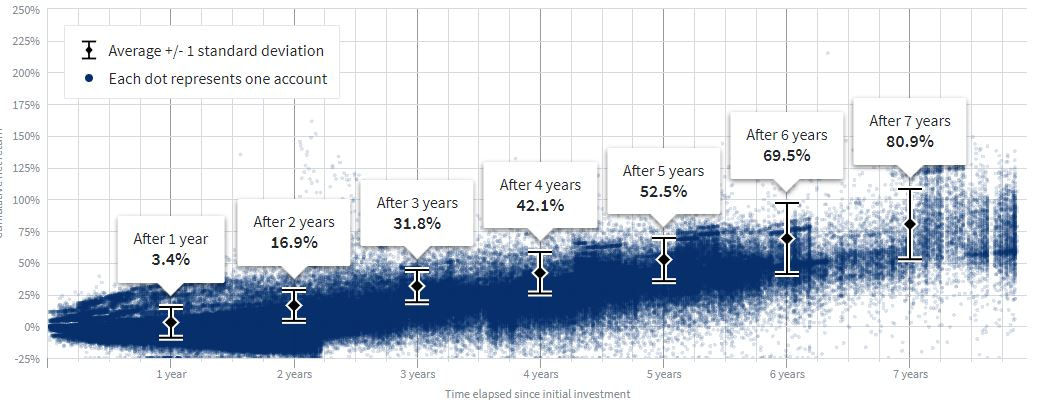

Fundrise offers detailed data on investor returns. As you may see, common returns are strong, however some accounts ship returns effectively beneath the common.

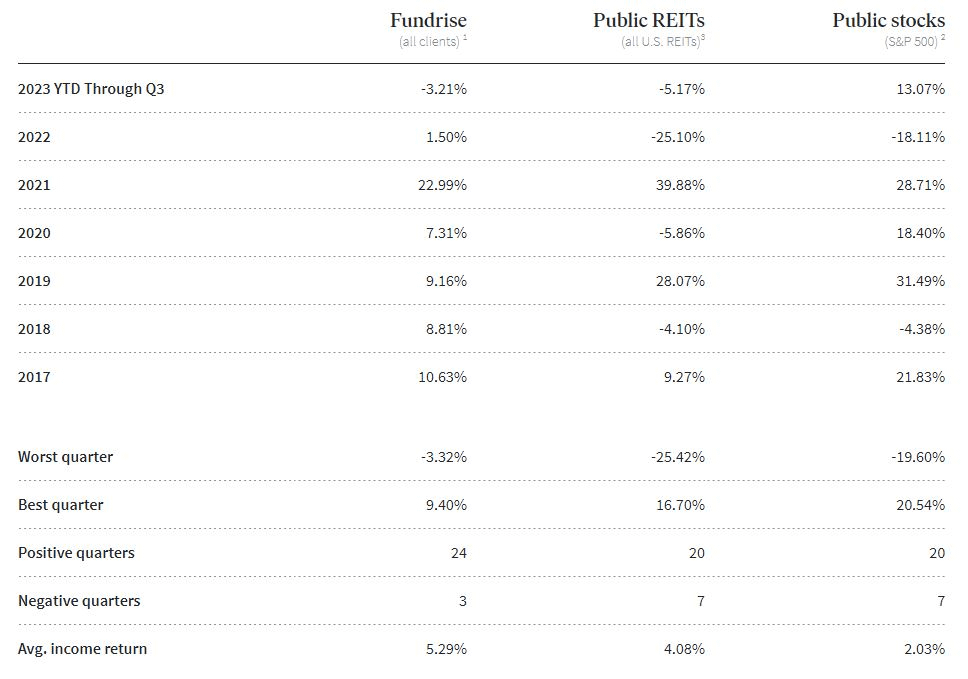

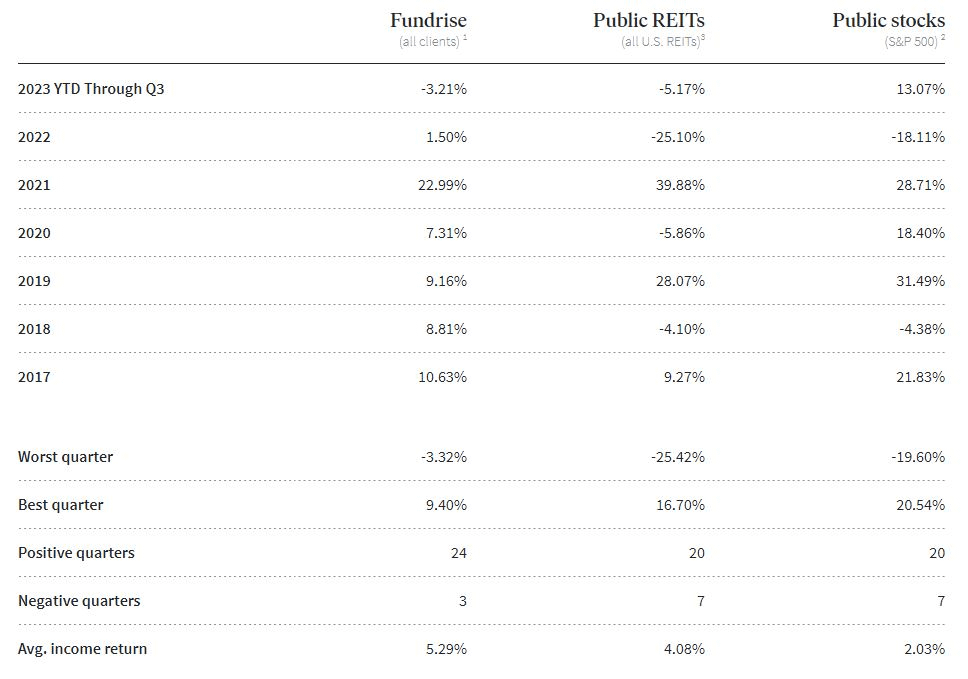

Fundrise additionally offers knowledge on returns vs public REIT and the S&P 500. Once more, these are averages and never all portfolios will ship the identical efficiency.

It’s clear from these figures that Fundrise can ship very aggressive returns. It’s additionally clear that these returns are usually not assured.

You will have to pay shut consideration to the composition of your Fundrise portfolio, particularly if you’re utilizing one of many extra customizable plans. Evaluating these portfolios would require vital analysis and experience.

Prices

Fundrise affords a typically low-cost investing mannequin. There may be an annual advisory price of 0.15% or $1.50 for each $1000 you’ve got invested. This price doesn’t cowl precise fund administration bills.

There may be additionally a administration price of 0.85%, which replaces the per-fund administration charges charged by many fund managers.

This quantities to a complete of 1%/yr in administration prices.

It’s possible you’ll be required to pay a 1% early redemption price for those who select to redeem your fund shares after a holding interval of lower than 5 years.

The Flagship Fund and the Earnings Fund don’t cost any penalty for quarterly redemptions, however Fundrise can freeze redemptions in periods of financial stress.

There could also be extra charges related to particular tasks. These will solely be acknowledged within the providing paperwork for the mission, so that you’ll have to learn these rigorously.

Dangers

Any funding includes dangers, and Fundrise isn’t any exception. Be sure you take into account these elements.

- Low liquidity. Fundrise affords personal funds designed to be held for no less than 5 years. Redemptions can be found quarterly, however chances are you’ll pay a price for those who redeem earlier than 5 years have handed.

- Attainable redemption freeze. Fundrise reserves the precise to droop redemptions in periods of financial stress. It’s possible you’ll not be capable of withdraw your cash.

- Complicated funding automobiles. Fundrise affords an enormous vary of choices, notably of their greater tiers. Precisely assessing these choices could require time and experience that many buyers don’t have.

- Charges could also be greater than anticipated. The essential price construction is cheap and accessible, however particular person tasks could carry charges and restrictions of their very own, which is probably not as simple to seek out.

- No assurance of efficiency. As with all investments, there is no such thing as a assurance {that a} Fundrise portfolio will ship the anticipated returns. Whereas common returns are aggressive, previous outcomes don’t guarantee future efficiency, and a few accounts have delivered below-average returns.

- Tax points. Earnings out of your Fundrise portfolio might be taxed as common earnings, not as capital features or dividend earnings. You need to keep in mind this when evaluating potential returns to these of different investments.

Not like some competing platforms, Fundrise has not invested in tasks through which the property developer did not ship the anticipated property and the cash successfully disappeared. That doesn’t imply that it could’t occur sooner or later, however based mostly on its observe report thus far, Fundrise has typically finished a superb job vetting and managing its tasks.

Person Critiques

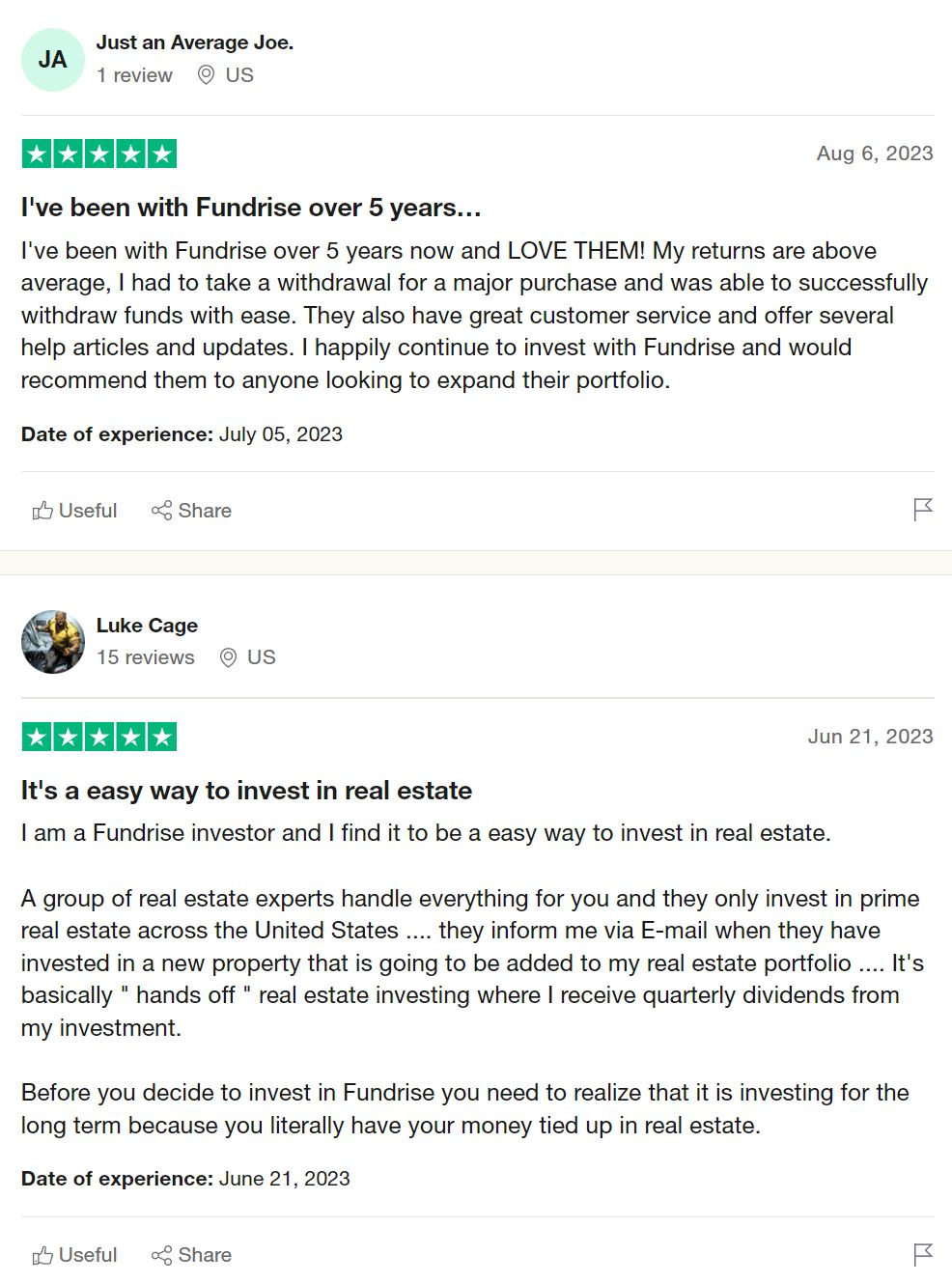

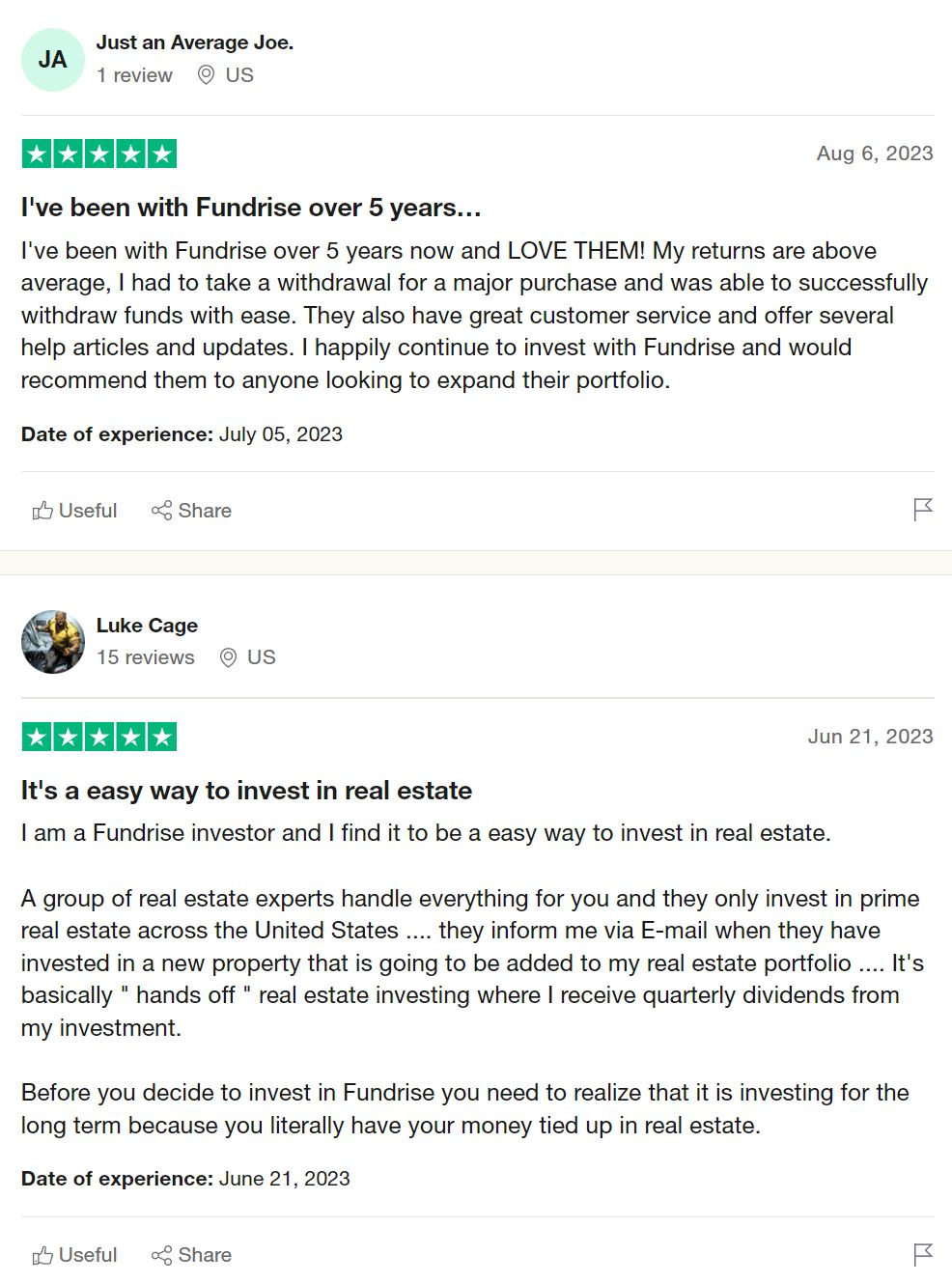

Fundrise has an A+ ranking from the Higher Enterprise Bureau (BBB), indicating a excessive diploma of responsiveness to complaints. The location has solely 8 evaluations and 30 complaints, all resolved over the past three years. It’s not attainable to attract a related conclusion from such a small pattern.

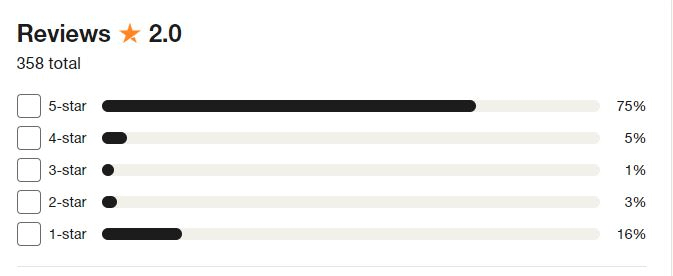

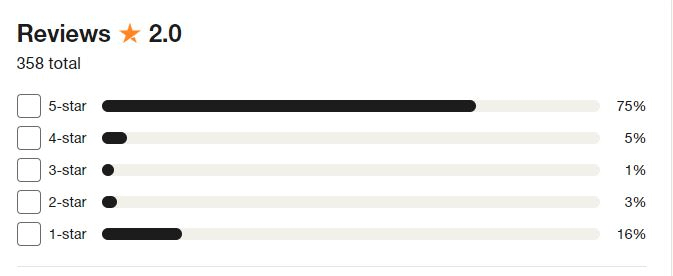

Fundrise has 358 evaluations on Trustpilot. The common is 2 of 5 stars, which is poor. On the identical time, Trustpilot reviews that 75% of evaluations are five-star and 16% one-star, with the remainder scattered between.

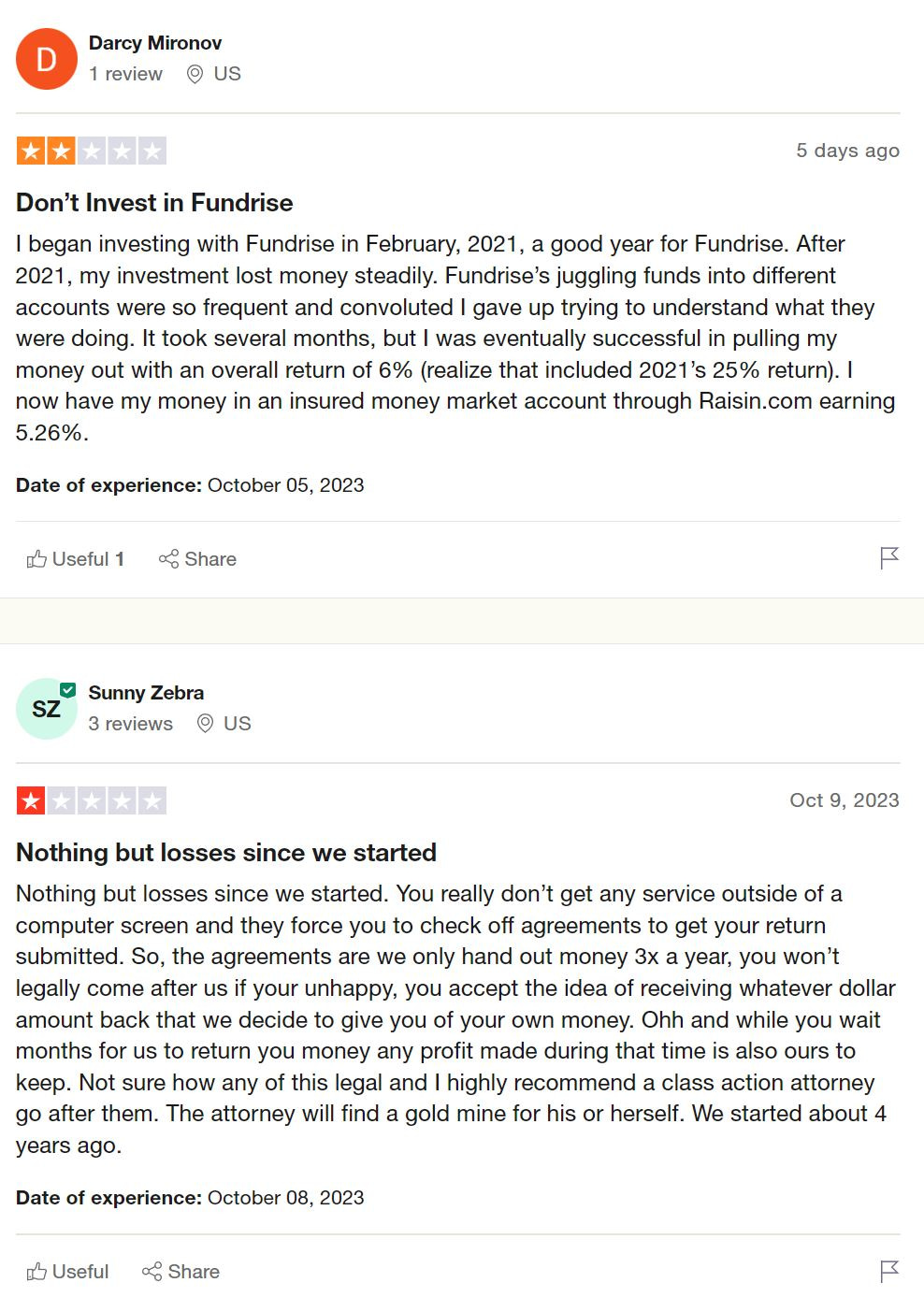

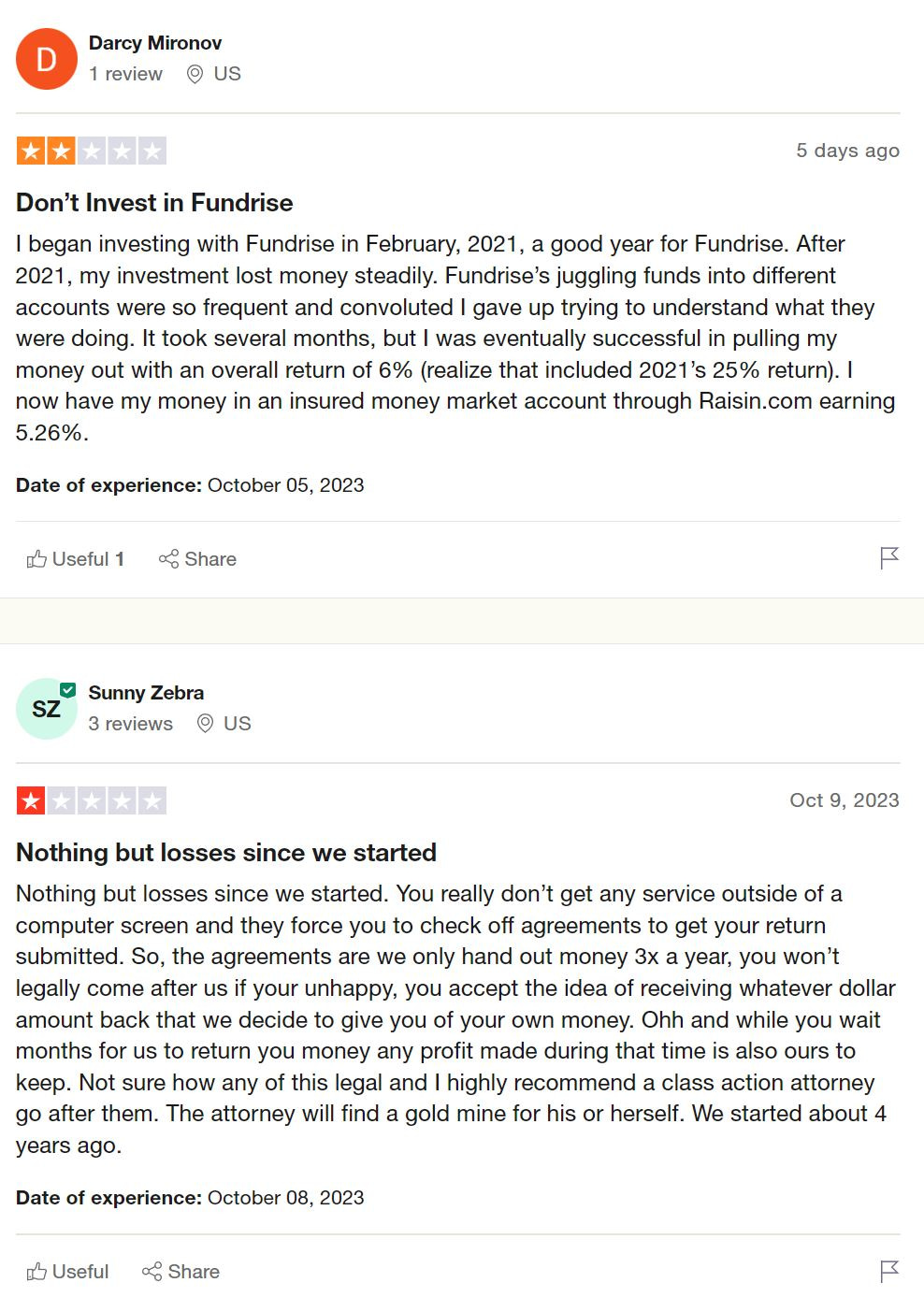

Studying the evaluations, there’s a transparent division between those that had been proud of their returns and those that weren’t. This may increasingly stem partially from a failure to completely perceive the character of the funding from the beginning.

Some buyers had been clearly sad.

Others had extra favorable experiences.

When you do select to spend money on Fundrise, it’s vital to acknowledge that these funds are complicated and they’re actively managed: fund composition could change quickly. There isn’t a assurance {that a} given stage of return – or any return – might be achieved.

Is Fundrise Proper For You?

Fundrise affords accessible publicity to different asset courses equivalent to actual property, personal credit score, and personal fairness. You’ll be able to diversify into these asset courses with investments as little as $10.

That could be a substantial benefit over platforms which are solely accessible to accredited buyers.

Simply because you may, after all, doesn’t imply that you need to. A Fundrise funding will tie up your funds for a considerable period of time, and chances are you’ll pay a penalty if it’s essential to withdraw early.

When you’re contemplating a Fundrise funding, ensure that you’re assessing not solely the potential returns you could possibly get from Fundrise but in addition the attainable returns you could possibly get from different makes use of of the identical funds.

Fundrise has achieved a strong report in its 13 years of operation. Not all portfolios have been worthwhile and never all years have been constructive returns, however the firm has prevented scandal and main points and is a viable possibility if you wish to diversify into different asset courses with out a main dedication.

When you’re contemplating a brand new funding in any asset class, it’s all the time a good suggestion to seek the advice of knowledgeable funding advisor.

🏡 Study extra: Improve your property funding data with our number of the greatest books on actual property investing.