[ad_1]

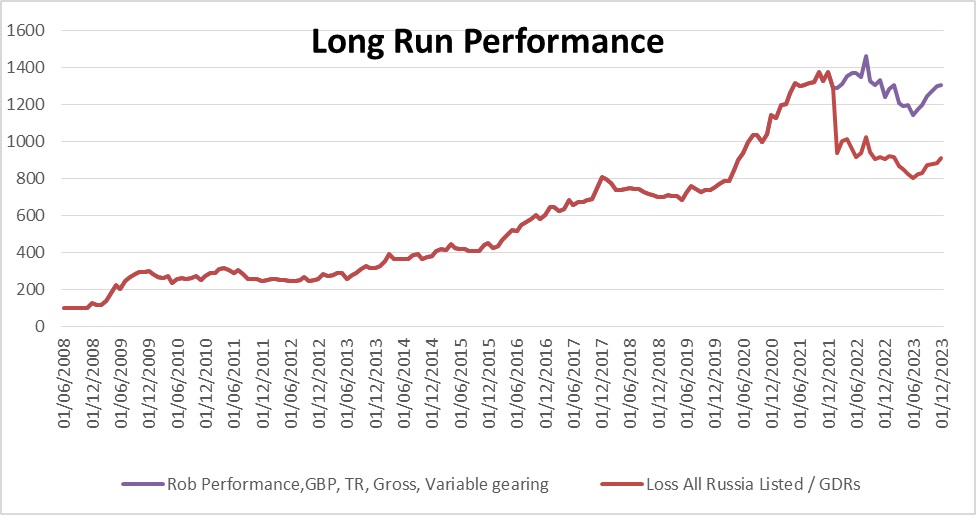

Common finish of yr evaluate right here. It hasn’t gone nicely, total +0.8 (excluding Russian frozen shares) or +5.4% together with Russian frozen shares. If Russia goes again to regular will likely be up much more as there are loads of dividends ready to be collected, not included within the beneath.

Linking again to final yr I used to be just about unsuitable about every thing. I used to be closely into pure useful resource shares (c57% weight vs 41% now), not the most effective sector in 2023. A few of the fall in weight is because of me mildly slicing weights as shares didn’t go my method / although fairly a bit is because of value falls. I had moments of fine judgement – noticed the likelihood for political change in Russia – which very practically happened with the Prigozhin mutiny, bought into financials late within the yr. Broadly issues haven’t labored. There’s a delicate constructive component to this – if I will be fairly unsuitable on virtually every thing and nonetheless not lose *a lot* cash it’s not too dangerous – however it’s removed from supreme given time I put in / potential returns. It’s additionally constructive I havent gone off the rails after the massive Russian loss final yr – its simple to chase / increase publicity, which is one thing I don’t suppose I’ve finished. There’s an argument round stops – which I don’t use – going to be somewhat extra cautious with shares purchased at highs – significantly Hoegh Autos.

Weights are beneath:

Figures are as at twenty third Dec – so somewhat approximate – however a usually correct flavour of the place I’m. (some very illiquid shares like ALF costs are incorrect…

Not inclined to alter sector weights an excessive amount of, much less treasured about shares. I’ve additionally been fairly badly hit by manufacturing issues, AAZ had tailing dam points, PTAL – points with the natives, JSE – manufacturing issues. Unsure if that is simply dumb luck or a few of these issues had been within the value – I definitely knew PTAL had issues with ‘group relations’. JSE’s issues with their FPSO (floating manufacturing ship) may have been forseen if I had researched higher – essential to look into age of vessels, didn’t know/suppose to do it on the time nonetheless. These few hundred million market cap shares are way more susceptible than I believed- money piles can evaporate in a short time in the event that they hit points.

Strikes in a few of my bigger weight useful resource co’s that I proceed to carry have been unlucky – CAML -27%, KIST -61%, TGA -53% and THS -32%. While gasoline and coal are down considerably copper is about buying and selling on the value it was in the beginning of 2023, Tharisa’s basket isnt down that a lot. CAML is buying and selling at a PE of 8, 9% yield, THS PE of three.5, 1/4 ebook, although marred by a administration who insist on development capex while buying and selling sub ebook. They could get fortunate if costs rise however it’s luck, not judgement. TGA, additionally very, very low-cost 7% yield, low single digit PE, once more, irritatingly, investing somewhat than returning capital. These giant falls will not be sensible from a capital preservation perspective, one wants a 100% rise to counter a 50% fall. But when we do get a choose up within the financial system / useful resource costs these may simply get again the place they had been. There may be an argument these can simply rerate with the market, although at current they only appear to be disliked. PTAL appears to be doing nicely with respectable prospects and a ten%+ yield, with buybacks – all relies on the oil value. Draw back to all that is being commodity producers they solely have a lot management over their destiny – why many traders dislike them.

A inventory which has had manufacturing points is GKP – Gulf Keystone Petroleum it’s points concern the legitimacy of it’s manufacturing contract / pipeline entry. It’s the one one I’ve added to somewhat than lowered over the yr – averaging down. The entire Kurdish oil business has a query mark (relying on who you take heed to) concerning the legitimacy of it’s contracts. However, I can’t consider an instance the place a complete business was seized / nationalised / expropriated. Everybody – Kurdish govt / Iraqi govt and oil corporations have mentioned that contracts will likely be revered / discussions are ongoing. It’s removed from threat free – I believe greatest threat is that one firm is punished / seized to encourage a deal to be made by the others. Big upside on this – it’s a really giant area with very low extraction value – despite the fact that the oil isnt the highest quality, if made reliable relying on the precise deal. They’re greater than protecting their prices so for my part price a glance in case you have threat tolerance for a considerable loss. If this works it’s a 3x-5x or extra, however it’s one the place the end result is basically outdoors administration’s management – for causes aside from commodity costs.

Considered one of my greatest performing investments is JEMA – previously JP Morgan Russia. It’s an odd one – buying and selling at 48p ‘official’ NAV with a share value of c £1.30 and a MOEX NAV at about £5-£6. JPM have marked all of the Russian holdings to about 0. I’m up about 55% and have trimmed the place – promoting a few third already. There’s rising speak of seizing Russian property to pay for the subsequent spherical of Ukraine funding. Not completely certain what to do on it – upside remains to be large however I have already got 30% of the portfolio worth in Russian, sanctioned shares. I dont really want an additional weighting to turbo charged Russian publicity with the identical dangers – going to have to chop this to handle threat however considerably reluctant to, given the upside… I imagine loads of the frozen Russian property are held by Clearstream in Belgium , however uncertain to what diploma Belgium actually makes the decisons on that one. Russia seems to have ‘received’ no less than to a point militarily – they’re making gradual progress, nonetheless they’re eager to have ‘peace’ / stop fireplace talks. I believe it’s because their wins will not be sustainable, human losses/ monetary value is simply too heavy to be sustained. Ukraine lacks the manpower and doubtlessly arms for an ongoing attritional combat however Russia lacks the motivation. My view is Russia cracks first and we see extra mutinies in 2024.

Uranium commerce has gone nicely – KAP/URNM up 43/53%. Have switched somewhat bit of cash out of URNM into YCA – possibly the steel will proceed to outperform the miners for fairly some time. I’m considerably skeptical of YCA / SPUT shopping for Uranium to tighten the market – as an industrial commodity – it solely actually has worth if it’s used – so implied value of spot / spot -% means in the future will probably be used, and if will probably be used then tightening of the market most likely shouldn’t occur. Not how individuals are taking a look at it in the intervening time although.

Financials have finished nicely – regardless of me including Nov/Oct in order that they haven’t had an excessive amount of time to contribute. October costs for plenty of funding trusts / asset managers and many others. (largely UK primarily based) appeared very depressed, 10% yields 40% and many others low cost to ebook values. Startling how rapidly issues have bounced. Not completely certain greatest option to deal with these long run, they could possibly be a pleasant strong earnings play, purchased at excessive yields or if I discover one thing higher then time to promote . I wrote about these not too long ago in this put up. I’m a bit involved about them as a long run maintain – the upside may be very a lot restricted, although excessive likelihood. I favor to be within the ‘actual’ inflation linked financial system, laborious property somewhat than the monetary financial system.

A monetary I purchased after that put up is PHNX – Phoenix Group – it is a giant closed life insurance coverage supervisor it’s buying and selling at a good 9% yield. The dividend is £500m for an organization which is producing £1.3-1.4bn pa in money and which has £3.9bn solvency 2 surpulus – it must be sustainable. As ever with hyper large-cap insurers as an beginner you might be by no means fairly certain what the regulator will give you which is able to damage your day. You might be additionally betting towards the brand new weight reduction medicine rising lifespan – although of late expectancy has been falling unexpectedly. Not one I’ll maintain for too lengthy – I’m desirous about a yr or two, however I believe it’s under-priced. Looking for alpha write up right here (not by me).

Bought out of AA4 and DNA2 – respectable income on each (+100% on some tranches, held since 2020) however I believe there are higher locations for funds now. I could also be lacking out on a little bit of upside if the A380 finds extra of a market – maybe if one other airline begins utilizing it, although I doubt it’s logistically easy. There at the moment are higher alternatives on the market, although AA4 could have extra upside however at increased threat.

Fondul Proprietea is now a tiny weight – after tender presents / returns of capital. Its somewhat unhappy to be saying goodbye. I got here up with this concept again in 2012 and have benefited from a closing of a 50% low cost and development in underlying investments – it’s actually the perfect funding. It has had a 962% rise since inception (2011) and I’ve owned it since 2012 – although now and again have needed to drop it attributable to dealer points. Time to promote this – as there isn’t an excessive amount of upside left now. Actually struggling to seek out issues with this degree of high quality / cheapness / ongoing compounding alternative.

Having mentioned this, one which can match the invoice is Beximco (BXP) it is a Bangladeshi Pharma, buying and selling at a PE of 5, doubled income since 2018 (in BDT, however even in USD it has grown impressively) and it has considerably elevated earnings (my 2019 write up right here). It’s at present buying and selling at half the place it’s in Bangladesh however there isn’t a arbitrage alternative. Frustratingly, I needed to reduce my weight as my dealer wouldn’t enable it in a tax environment friendly ISA account, this didn’t damage me as the value fell. My dealer has modified their thoughts so now I can put it again and lift the burden. Brokers right here appear to depend on giant screening corporations and drop / add corporations to the listing of what’s eligible – not relying on the principles however how they really feel on the time.

Walker Cripps may be very a lot the worst type of worth funding – the one the place nothing occurs. Walker Cripps is reasonable on an AUM foundation however hasn’t moved since I purchased it in 2015. Presumably I’ve given this too lengthy, then once more there may be consolidation within the sector and this may be excellent for it… The FOMO of figuring out the day I promote it a suggestion will likely be made at 3x the present value retains me holding, my not insubstantial endurance is operating out.

I nonetheless have some leverage – however that’s low-cost mortgage / unsecured debt at 3/4% charges. Its a comparatively small quantity vs portfolio / portfolio + property property – about 20%/11%. In impact, as in prior years leverage is getting used to purchase gold / held on deposit at the next fee…

By way of life – no change, nonetheless dwelling within the UK, somewhat unhappily employed (low/mid degree information analyst) three days every week, doing investments / little little bit of property the remainder of the time. Actually wanting ahead to life beginning correctly when I’m not employed / ideally leaving the nation. Was considerably distracted by a pointless court docket case through the first half of the yr and didn’t see a lot alternative so didn’t do a lot. Second half has been higher, significantly after October. I nonetheless suppose a giant transfer in most of the useful resource co’s I maintain is probably going, so actually dont wish to transfer earlier than that occurs – as a rustic transfer will entail pulling fairly a bit out of shares. PE’s of underneath 5 will not be doubtless for my part to be sustained, although there’s a threat a sustained recession / despair shrinks earnings and share costs additional… I’d wish to get extra copper / tin / silver publicity however haven’t but discovered any shares I like, and ETF’s will not be with out their issues…

Suppose this yr has suffered from me largely being in respectable shares when it comes to yield / valuation however not shares the market cares about / likes which is why they’re low-cost. I may go extra mainstream however I’d somewhat keep the place I’m and look forward to the market come to me somewhat than chase… Not wedded to explicit shares however the weighting to the useful resource sector wants to stay – they’ve been underneath invested in they’re low-cost and retro – very a lot suppose they may have their day within the solar. Plan to modify again from a few of the funds to assets as soon as the financials get again to nearer to what I anticipate is their honest worth.

Shares I plan to take a look at subsequent are tobacco – BATS/IMB most likely – if I can get snug with authorized dangers / debt ranges, they’re yielding nicely and will not be extremely valued. After I should buy mainstream shares at single digit PE/ EV/EBITDA there isn’t a must go too far into unique territory. Not the most well-liked – they do kill their clients in any case, however vapes, hashish and many others could present a chance to really purchase development at a low value – significantly if regulation cuts out dodgy Chinese language imports. Nonetheless wish to rebuy Royal Mail on the proper value. Long term I would like extra Latin American / Asian listed shares. China appears to be like low-cost however I’m very cautious of avoiding a repeat of the Russian state of affairs.

Better of luck for 2024 – as ever feedback/views appreciated.

[ad_2]