Bitcoin is experiencing a extreme downturn over the previous few days. After buying and selling above $96,000 on Monday, its worth slipped under $80,000 at present for the primary time since November 11. This speedy decline marks an almost 18% hunch for the reason that begin of the week. From its all-time excessive of $109,588 on January 20, Bitcoin has now shed roughly 27% of its worth.

A number of components have converged to exert downward strain on the cryptocurrency. These embody the newly imposed Trump tariffs, large-scale outflows from spot BTC ETFs, and exceptionally excessive ranges of liquidations within the futures markets. Whereas sentiment has clearly taken successful with the Worry and Greed Index at 16 (“Excessive Worry”), some analysts word that these circumstances may be setting the stage for the subsequent important transfer––be it additional draw back or a possible rebound.

Associated Studying

How Low Can Bitcoin Go?

Famend crypto analyst Scott Melker, often known as “The Wolf Of All Streets,” highlights a creating bullish divergence on a number of timeframes. In a submit on X, Melker writes: “BTC 4-HOUR: Bullish divergence nonetheless constructing after the hidden bearish divergence I used to be expecting. This might fail, clearly, however RSI is holding up nicely. In case you have been following me for years, that is my favourite sign when confirmed. Oversold RSI with bullish divs constructing over a number of timeframes.”

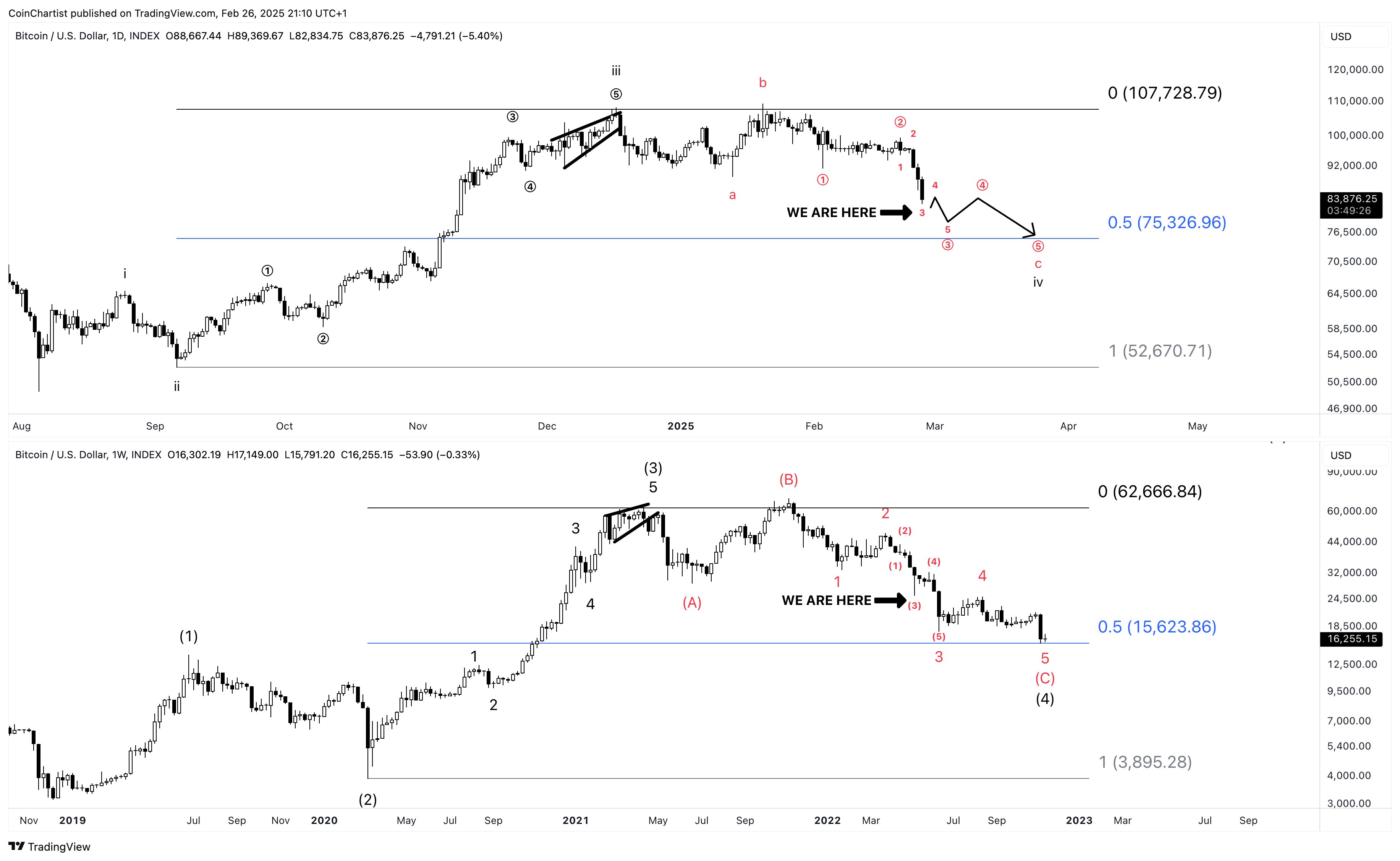

Technical analyst Tony “The Bull” Severino, CMT (@tonythebullBTC) believes the market could also be tracing out a well-recognized corrective sample just like what occurred in 2021 and 2022. He suggests this sample “may get an prolonged fifth of a fifth state of affairs that takes us nicely into late 2025.” He added that “this does imply this might go lots decrease than many expect, to about $75,000 if the identical larger diploma fractal is adopted to the 0.5 Fib retracement.”

Severino additionally cautions that merchants “don’t need to see Bitcoin tag the month-to-month Parabolic SAR, at the moment positioned at $75,742,” as a breach of that degree may sign a deeper correction. He expects the Parabolic SAR will rise barely by the month-to-month shut, probably pushing the vital help zone into the low $80,000 vary.

Associated Studying

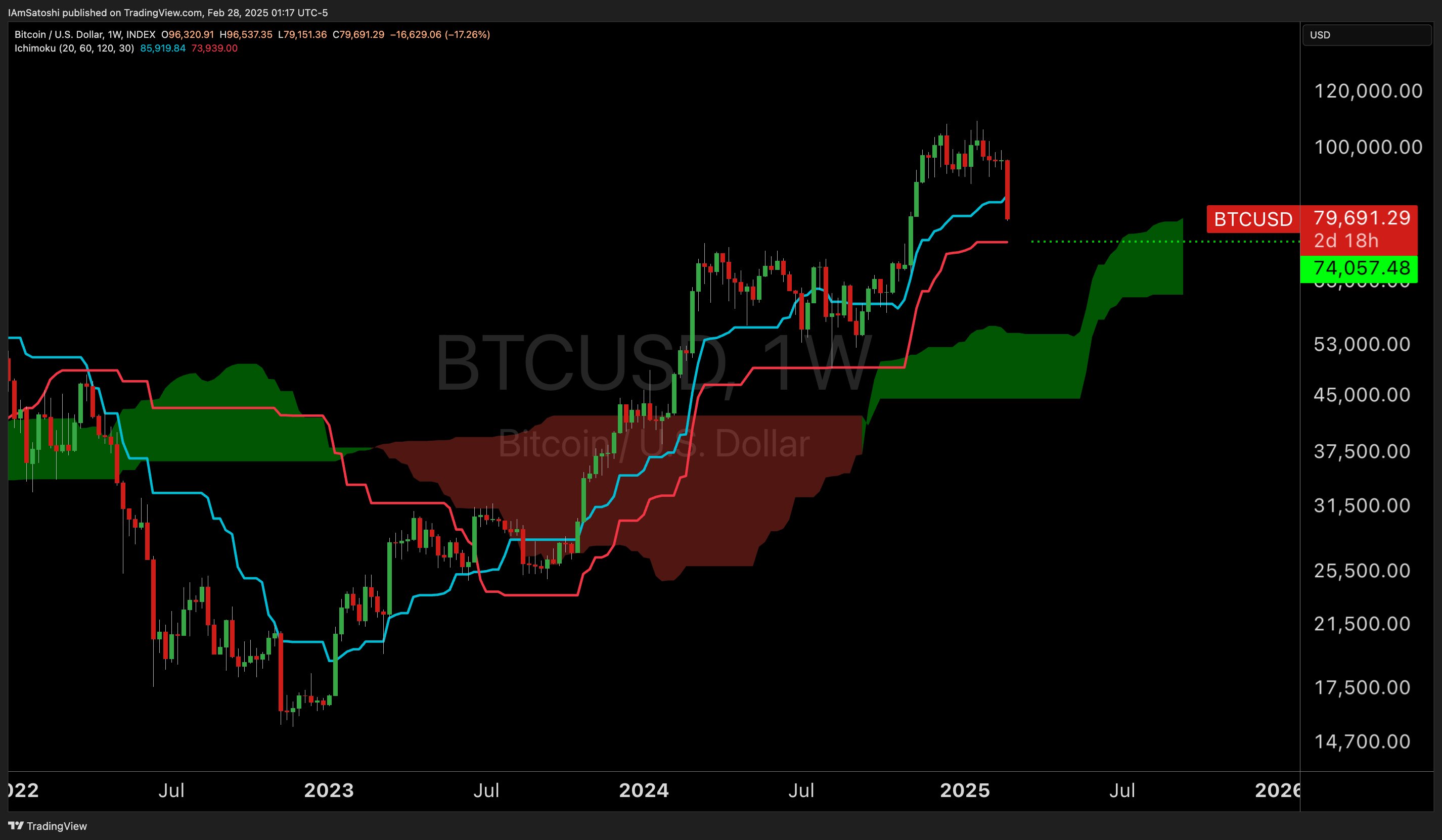

Outstanding dealer Josh Olszewicz (@CarpeNoctom) tracks the Ichimoku Cloud for key insights. He factors to a attainable retest of Bitcoin’s weekly kijun, referencing “weekly kijun help at 74k if we preserve going.” Olszewicz notes Bitcoin final tapped the weekly kijun throughout the yen carry commerce unwind in August 2024—an occasion that noticed heightened volatility throughout international markets.

Analyst Daan Crypto Trades (@DaanCrypto) attracts parallels with earlier market cycles when Bitcoin’s Day by day RSI dipped to the 20 degree: “The final time BTC was this ‘oversold’ [at 20] on the Day by day RSI was again in August 2023 when it was buying and selling at $25K. The time earlier than that was after the FTX implosion on the bear market backside in late 2022. Brief time period this implies little but it surely ought to begin peaking your curiosity.”

He additionally noticed important purchase orders on Binance futures: “BTC ~$1.8 Billion in Bids has appeared on the Binance futures pair. These bids are sitting between $70K-$79K. What occurs when bids like these seem is diversified. Typically worth by no means strikes into them, when it does begin hitting them, it usually fills plenty of them earlier than (shortly) reversing. Consider, these are bids that may simply as simply be pulled away. Highlighting this because it’s an insane quantity and that is one thing you not often ever see.”

Ki Younger Ju, CEO of CryptoQuant, highlights the position of liquidity in figuring out Bitcoin’s trajectory. He famous spot quantity was “extremely lively round $100K,” however defined that “costs drop when new liquidity dries up.” For Ju, the important thing query is: the place will recent liquidity come from if the market is already in a distribution part?

He foresees a possible prolonged consolidation between “$75K-$100K,” resembling Bitcoin’s worth motion in early 2024. Such a spread may persist till a recent catalyst emerges. “We’ll seemingly see an prolonged consolidation within the big selection (e.g., $75K-100K), just like early 2024, imo. This might final till some excellent news for Bitcoin brings in new liquidity,” Ju predicts.

At press time, BTC traded at $78,856.

Featured picture created with DALL.E, chart from TradingView.com