In its latest evaluation, market intelligence agency Messari has offered a complete overview of the NEAR Protocol’s efficiency in This autumn 2024. Regardless of going through headwinds within the broader crypto market, NEAR has demonstrated notable resilience by means of elevated exercise and strategic developments.

Drop In Market Cap Rating However Resilience By means of Elevated Exercise

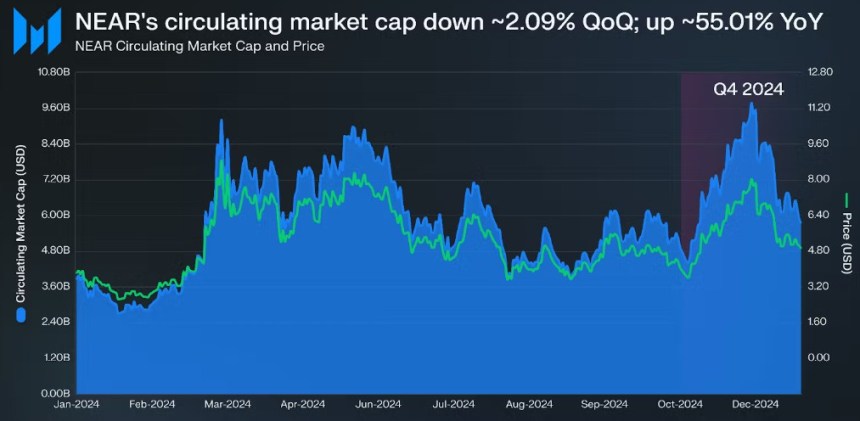

Throughout This autumn, NEAR Protocol initially surged, reaching a token worth excessive of roughly $8.19 in December earlier than retracing to round $4.91 by the quarter’s finish.

This decline mirrored a major drop in market cap, which fell to roughly $5.73 billion—marking a 2.09% lower quarter-over-quarter (QoQ).

Consequently, NEAR dropped ten spots in market cap rankings, now sitting at twenty first general, indicating a efficiency lag in comparison with different main belongings.

Regardless of the challenges in market pricing, NEAR’s income, derived from community transaction charges, noticed a considerable enhance. The income grew to about $2.11 million, representing a 26.81% QoQ rise. This development may be attributed to heightened transaction volumes and decentralized alternate (DEX) exercise.

The typical transaction charge in the course of the quarter was roughly $0.0031, a 15.91% enhance from the earlier quarter, additional highlighting the community’s operational effectivity.

Associated Studying

The NEAR token performs a multifaceted function inside the ecosystem, being important for staking, transaction charges, and storage charges. The protocol maintains a versatile provide mannequin, characterised by an annual inflation fee of 5%.

Of the inflationary rewards, 90% are allotted to validators, whereas the remaining 10% helps the protocol’s treasury. As of the top of This autumn, roughly 95.12% of NEAR’s whole provide was in circulation, with about 49.08% actively staked.

The annualized nominal yield from staking was reported at round 8.95%, with an actual yield of 4.55%, offering enticing incentives for holders to stake their tokens.

NEAR loved a surge in deal with exercise and transaction quantity throughout This autumn. The typical day by day lively returning addresses rose by 15.82% QoQ, reaching 3.55 million, whereas the typical day by day new addresses surged by 29.05% to 361,046.

Nonetheless, the protocol confronted a decline in developer exercise, with weekly lively core builders lowering by 13.95% to 159 and ecosystem builders falling by 30.34% to 129.

NEAR Balances Market Setbacks With Promising Improvements

NEAR’s DeFi whole worth locked (TVL) concluded This autumn at roughly $240.16 million, reflecting a 4.48% decline from the earlier quarter. The Liquid Staking TVL additionally skilled a lower of round 10.32% QoQ, settling at about $250.81 million.

Notably, the LiNEAR Protocol’s TVL was roughly $132.41 million, down 8.77%, whereas Meta Pool’s TVL declined by 11.78% to round $111.70 million.

Associated Studying

On a optimistic notice, NEAR’s common day by day DEX quantity reached roughly $8.45 million, marking a 25.40% enhance from the earlier quarter. Ref Finance emerged because the main DEX on the platform, accounting for a median day by day quantity of $8.35 million.

This autumn additionally noticed an uptick in NEAR’s stablecoin market cap, which grew to about $683.69 million—a rise of 1.88% QoQ and a staggering 880.71% year-over-year (YoY).

As of now, the NEAR’s worth stands at $3.52, recording a considerable 10% surge previously two weeks. But, nonetheless 82% under its all-time document excessive.

Featured picture from DALL-E, chart from TradingView.com