[ad_1]

Final March, I wrote right here about SingleFile, an organization whose mission is to assist companies navigate complicated regulatory environments effortlessly by automating outdated submitting processes and leveraging AI know-how in a unified cloud platform.

As we speak, it took a serious step in driving that mission ahead with information that it has raised $9 million in Sequence A funding, bringing its complete funding to $24 million since its founding in 2019, together with $15 million raised previously 12 months.

The spherical was led by VC agency Foundry Group, which participation from current traders together with Pioneer Sq. Labs and The LegalTech Fund, in addition to regulation corporations Wilson Sonsini, Cooley, DLA Piper, Fenwick & West, Perkins Coie, and particular person attorneys from the agency Okay&L Gates.

“This new spherical of funding marks a major milestone for SingleFile as we proceed to revolutionize the best way companies and their trusted advisers deal with ever-increasing and repetitive compliance burdens,” mentioned Aaron Finn, SingleFile’s CEO.

The Seattle-based firm firm will use the funding primarily to broaden its know-how platform and scale operations, with a specific deal with analysis and improvement to convey further compliance capabilities to its platform, Finn mentioned.

The corporate has additionally expanded its govt crew, including Mindy Lauck as chief product officer and Teresa Kotwis as chief monetary officer. Lauck has been a CEO and product chief at a number of firms, whereas Kotwis likewise has been CFO at plenty of startups and established firms.

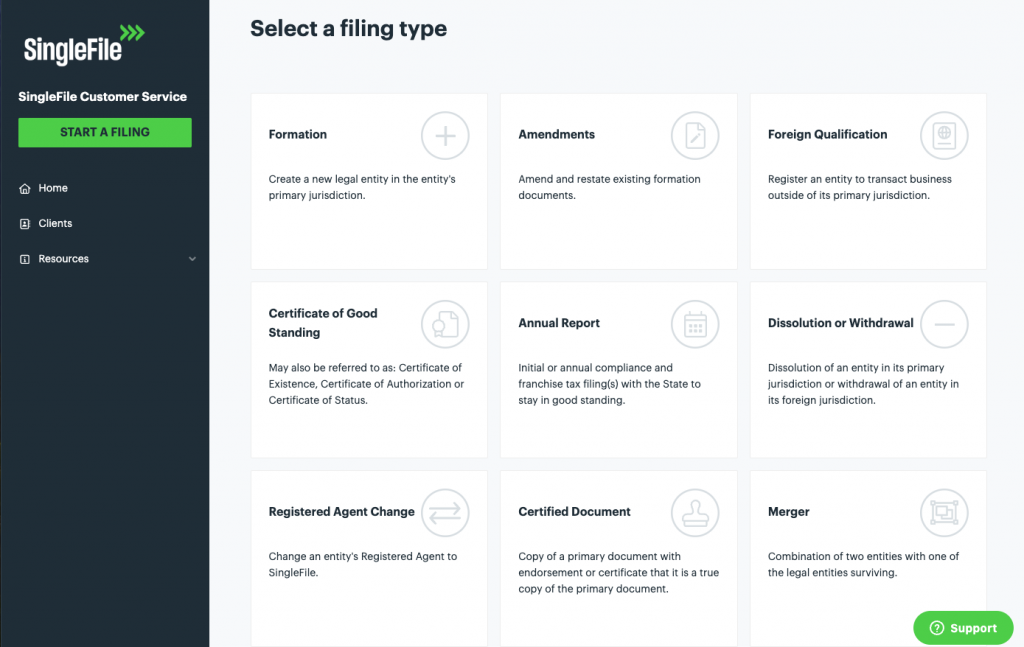

Digital Compliance Platform

The corporate, which spun out of Pioneer Sq. Labs’ Seattle incubator in 2019, serves regulation corporations, companies and investor corporations with a digital platform for submitting and monitoring annual stories and different state-required filings. It additionally presents entity administration and resident agent companies.

Final yr, in anticipation of the useful possession submitting necessities below the Company Transparency Act taking impact, the corporate launched a module particularly for CTA reporting. The CTA requirement helped the corporate’s enterprise pipeline “blow up,” Finn advised me final March.

Regardless of present uncertainty round CTA implementation attributable to numerous authorized challenges, Finn mentioned the corporate continues to see substantial development, significantly in relation to CTA compliance. In truth, it skilled its most important development since inception throughout November and December, with utilization by regulation corporations rising greater than threefold in comparison with the earlier yr.

“Even with the CTA uncertainty that occurred throughout that point, it was nonetheless numerous development for us and numerous prospects desirous to get filed earlier than that unique deadline and a few simply desirous to get able to file,” Finn mentioned in an interview.

He mentioned the corporate continues to realize important traction within the authorized market, and now serves greater than 60 regulation corporations, together with 33 Am Regulation 200 corporations, and greater than 4,000 prospects general.

One System of File

However as a lot because the CTA has been a boon to SingleFile’s enterprise, Finn emphasizes that it isn’t its solely enterprise and even nearly all of its enterprise.

“We consider that all your data, all your authorized entity data, must be maintained in a single system of document in order that when data modifications, it might probably replace any compliance filings which can be required,” he mentioned.

The corporate positions itself as bringing fashionable know-how to what has historically been a guide, paper-intensive trade.

“The entire thesis of our firm is that fashionable know-how may help take the guide paperwork burden out of this trade,” Finn mentioned. “We’re seeing it actually blossom with CTA, mixed with submitting and registered agent companies.”

Clients significantly profit from the SingleFile’s cloud-native platform, Finn believes.

“As a result of we’re utilizing cloud-based know-how, it permits any of the constituents which can be concerned in these compliance filings to have the ability to take part, whereas the corporate maintains the information in a single place and has that system of document.”

‘A Generational Enterprise’

Jaclyn Freeman Hester, accomplice at Foundry Group, cited the corporate’s “sticky product” and strategic distribution mannequin as components within the resolution to guide the spherical. “SingleFile has the makings of a generational enterprise — a sticky product that’s delivering distinctive worth to prospects, a strategic distribution mannequin, and best-in-class SaaS metrics,” she mentioned.

The corporate plans to make use of the brand new funding to broaden past its present choices into further compliance areas. Finn indicated that prospects have requested capabilities for blue sky filings, SEC filings, and enterprise licensing, amongst different compliance necessities which can be usually dealt with manually or by means of consultants.

“We simply need to preserve bringing an increasing number of of this compliance work into our automation and into our clever community.”

Whereas regulation corporations are a major channel for SingleFile’s companies, the corporate’s enterprise mannequin usually entails constructing direct relationships with the regulation corporations’ shoppers. The exception is in non-public wealth or non-public consumer teams at regulation corporations, the place the corporations themselves change into the direct shoppers.

‘Jurisdictional Intelligence’

SingleFile competes with conventional gamers within the registered agent and authorized submitting trade reminiscent of CT Company, owned by Wolters Kluwer, and CSC World. The corporate differentiates itself by means of what Finn describes as its “jurisdictional intelligence” — a cloud-native infrastructure that helps authorized entities registered throughout a number of jurisdictions perceive and keep their compliance necessities.

“Take into consideration all the federal government businesses which have all these necessities that companies have to comply with,” Finn mentioned. “… How can we go and take all this jurisdictional intelligence and convey it into one system that’s good sufficient to know and examine and be sure that any authorized entity that is likely to be registered in a number of jurisdictions throughout the globe is aware of what compliance necessities they should comply with to keep up good standing.”

Wanting forward, Finn sees alternatives to broaden the platform’s capabilities to deal with the broader panorama of company compliance necessities.

He mentioned the federal Workplace of Administration and Funds has estimated that compliance with federal code paperwork necessities alone creates over 10 billion hours of burden yearly on the U.S. economic system, with a good portion falling on companies — and that determine doesn’t embody all of the state codes a enterprise has to comply with.

“You’re speaking tens of billions of hours of non-tax compliance work that must be performed simply within the U.S. alone for tons of of tens of millions — 40 million to 100 million — authorized entities,” Finn mentioned. “You’re speaking about a number of paperwork burden for lots of people.”

[ad_2]